Challenges don’t seem to end for the airline industry. Major airlines globally are struggling to meet the upsurged travel demand as aerospace companies like Boeing (NYSE:BA) and Airbus Group SE (OTC:EADSF) are lagging behind in their deliveries. Single-aisle jets, mostly utilized for U.S. domestic flights or other short-distance travel, have waiting periods of several months, according to the Wall Street Journal.

Consequentially, carriers like United Airlines (NASDAQ:UAL) and American Airlines (NASDAQ:AAL) are forced to cut their flight frequencies and even withdraw from certain markets due to the shortage of aircraft. As of August, UAL received only seven out of the expected deliveries of 53 new Boeing single-aisle jets.

Though both Boeing and Airbus Group are trying hard to pace up their deliveries, supply constraints continue to be a huge bottleneck. Airlines have also been facing trouble in getting spare parts for their existing planes.

While Airbus stated that it might not meet its delivery targets for this year, Boeing is faced with bigger regulatory hurdles. The company is awaiting approval for its latest two variants of the 737 MAX.

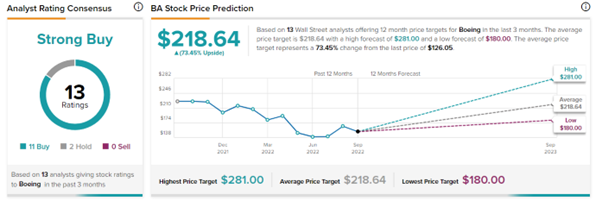

Is BA Stock a Good Buy?

The Wall Street community is clearly optimistic about Boeing stock, with a Strong Buy consensus rating based on 11 Buys and two Holds. Boeing’s average price target of $218.64 implies 73.45% upside potential from current levels.

The stock has a Very Positive signal from hedge fund managers, who added 1.1 million shares during the last quarter. Further, BA stock boasts a top-notch Smart Score of a ‘Perfect 10’ on TipRanks.

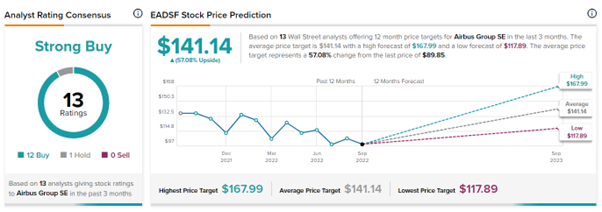

Is Airbus Stock a Buy or Sell?

The Street is highly bullish about Airbus stock. Overall, the stock commands a Strong Buy consensus rating based on 12 Buys and one Hold. EADSF stock’s average price target of $141.14 implies 57.08% upside potential from current levels.

Concluding Thoughts

With the huge uproar in travel demand, aircraft makers have gigantic backlog orders to fulfill. If supply constraints subside and deliveries are back on track, it could boost the stocks of aircraft makers in the coming months.

Meanwhile, Wall Street analysts feel that the current price levels for both Boeing and Airbus Group offer attractive investment opportunities.