Shopify’s (NYSE: SHOP) stock price recently popped after reporting better-than-expected earnings last week. SHOP stock surged over 17% after the e-commerce service provider saw its sales grow by 22% from the prior-year period and reported a narrower loss. Moreover, its stock price trades at roughly 6.75x forward sales when looking 12 months out, which could seem like a bargain. However, with multiple headwinds ahead and better investments in the space, it’s best to wait for a better entry point before investing in SHOP stock, as it can easily shed another 30% from here, in our opinion. Therefore, we are bearish on SHOP stock.

Growth investors are likely to be interested in buying the dip in SHOP stock, trading at multi-year lows. To be fair, the stock is cheaper than ever, suffering a massive de-rating since the start of 2022 with a forward price-to-sales ratio of 31x. It’s been mostly downhill for the stock over the past 12 months. However, its peers, such as e-commerce giants MercadoLibre (NASDAQ: MELI) and (NASDAQ: PDD) Pinduoduo, both trade at about 3.7x next year’s sales while growing significantly quicker.

Nevertheless, Shopify’s solutions continue to provide a valuable service for small merchants. This year, revenue growth has slowed incredibly amid multiple headwinds, but the company remains an attractive story over the long run as it builds out more features to grow its moat.

However, its near-term troubles are substantial, making it an unattractive bet. In all likelihood, SHOP stock could still easily shed another 30% of its value, as we mentioned before, to put it around its IPO price of $17 before it’s too cheap to ignore.

Interestingly, SHOP stock has a 3 out of 10 Smart Score rating on TipRanks, implying that the stock is likely to underperform the market, going forward.

What Happened in Shopify’s Third Quarter?

The company surprised investors by reporting better-than-expected results. Earnings per share came in at a negative two cents, beating the consensus estimate by five cents. Moreover, revenues also exceeded expectations by $30 million. However, Shopify was helped by multiple downward revisions to analyst estimates, which allowed the firm to post an earnings surprise.

The company’s results looked good on paper, but there was plenty wrong if you dig into the details. SHOP’s numbers were helped by its acquisition of Deliverr. However, the bump in sales was dwarfed by the 37% growth in expenses. The company’s gross profits are still climbing but are more sluggish than before.

Back in 2019, Shopify purchased two companies as part of its business-boosting efforts. The first was an influencer marketing start-up, and the second helped them strengthen its lower-margin logistics merchant network. However, both acquisitions and its recent purchase of Deliverr continue to strengthen its low-margin merchant solutions business. Investing and expanding its high-margin subscriptions segment would’ve been a better option for Shopify, with its bottom line in the red.

Hence, Shopify has become a cash-burning machine of late. Analysts expect it to post a whopping net loss of over $3 billion this year, followed by a much narrower loss the following year. The company’s current financials make it difficult for them to break even, and with interest rates rising at a rampant pace, its profitability situation could worsen.

With stiffer competition, Shopify is facing an uphill battle to maintain its position in the e-commerce space. Also, market saturation could ultimately limit its pricing power, making it even more difficult to narrow its losses.

Is SHOP Stock a Buy, According to Analysts?

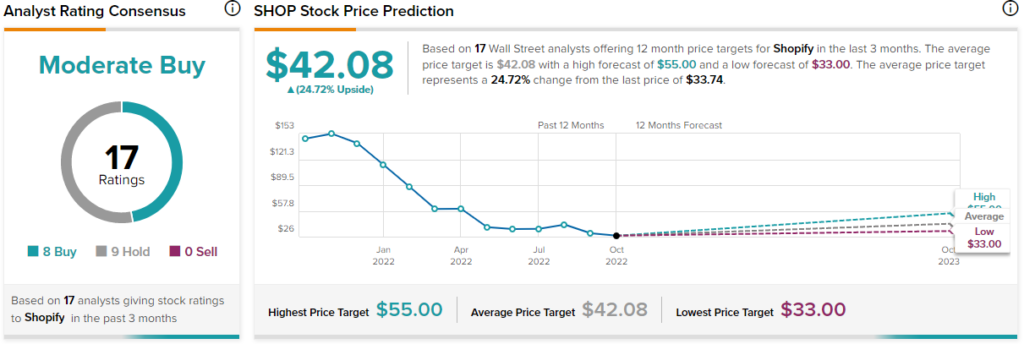

Turning to Wall Street, SHOP stock maintains a Moderate Buy consensus rating. Out of 17 total analyst ratings, eight Buys, nine Holds, and zero Sell ratings were assigned over the past three months.

The average SHOP price target is $42.08, implying 24.7% upside potential. Analyst price targets range from a low of $33 per share to a high of $55 per share.

Conclusion: Shopify Remains Risky

Shopify’s struggles are due to slowing revenue growth, a lack of profitability, and a challenging economic outlook. The company also faces intense competition in its industry due to the deteriorating macroeconomic backdrop affecting all businesses. It will continue to face tough competition in the market, and its days of hyper-growth figures seem to be over.

The stock has faced immense selling pressure this year and should continue to struggle in line with the rest of the market. Investors may question whether they’ve paid a reasonable price for the company if we enter into a recession in 2023. The lack of earnings will likely make them think twice before investing more money into Shopify, a former growth stock unlikely to recover soon.

If the company doesn’t make a comeback soon and post profits, its shares will probably get hammered. Therefore, it’s best to avoid bottom-picking and wait for a better entry point to invest in the stock. There are plenty of value-trap opportunities in the current bear market, and SHOP stock fits the bill.