The Solana price action was largely battered after the collapse of FTX, which brought prices down by over 60% in just ten days. While the SOL price managed some minor gains in the last week, larger market blues still plagued it.

On Nov. 24, a whiff of fresh gains pushed SOL price by over 20% from the multi-month low of around $10. After losing the $30 level, the Solana price fell straight through $20 and oscillated around $14 at press time.

While spot market price action was largely Bitcoin-dependent, Solana made some strides in the futures market.

Solana open interest pumps

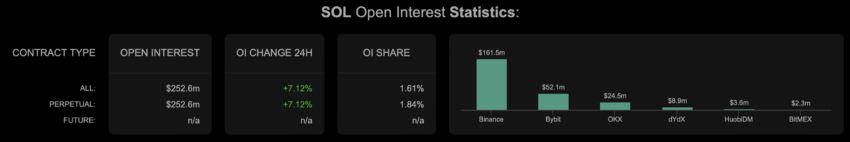

The values of open interest and funding rates help understand which way the market is headed and whether the price trend could change. Open interest for Solana saw a more than 7% rise alongside largely bearish price action. SOL open interest stood at $251.5 million at press time.

With open interest rising and price action still largely bearish, it could signal more short positions being opened in the market. The funding rate was still negative, which meant that short-position traders were dominant and were willing to pay long traders. This is typical of a bearish trend.

The overall outlook suggested a prolonged recovery as bears dominated bulls. However, with the bearish trend already weakening, a relief rally like the one that recently took place wasn’t surprising.

SOL development on point, but traction remains low

Despite the larger bearish price structure, SOL still had glimmering development activity. Development activity appreciated throughout November, while the development activity contributors metric maintained above-average levels.

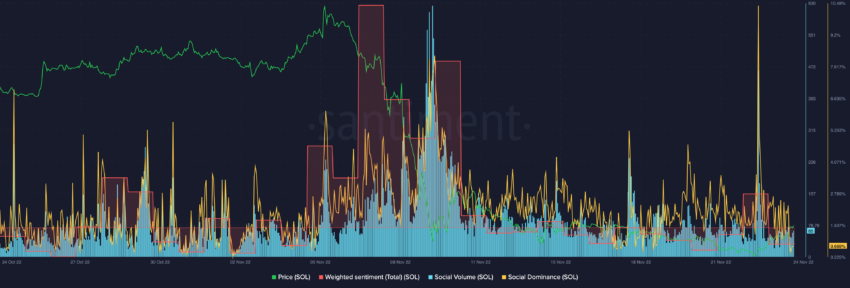

However, the social volumes for Solana still presented no major social media activity around the asset. Total weighted sentiment for SOL was still negative, while social dominance also took a hit.

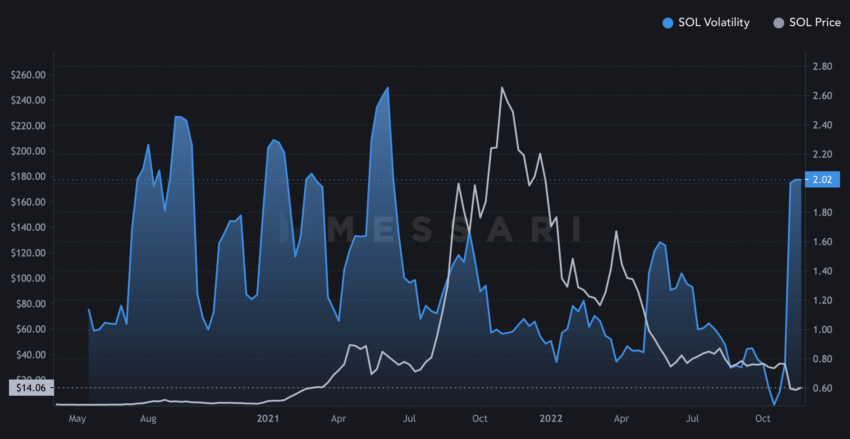

That said, a massive uptick in volatility helps explain the recent 20% gains.

Volatility is at a six-month high, which has led to significant swings. However, with volatility peaking, SOL traders can likely expect similar swings in either direction in the near term.

For the SOL price, the $20 psychological resistance could make play an important role in confirming recovery. If the bearish price action takes over, prices could potentially test the $8 level as support.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.