- GBP/USD refreshes three-month highs above 1.2153, extending its three-week winning streak.

- The US Dollar resumed a downtrend on dovish Federal Reserve policy tightening outlook.

- Acceptance above the 200-Day Moving Average is critical, with eyes on the United States data.

GBP/USD booked a third straight weekly advance and gained over 200 pips on the week, as broad-based United States Dollar (US) weakness emerged as the key driver amid a holiday-shortened Thanksgiving week. GBP/USD buyers now look forward to a fresh batch of top-tier economic events from the United States for the next push higher.

GBP/USD buyers retained control last week

The Pound Sterling bulls remained unstoppable amid a relatively quiet week and a clear dominance of the US Dollar bears. The US Dollar incurred a weekly loss, undermined by the prospects of the United States Federal Reserve (Fed) slowing monetary policy tightening as soon as December. A dovish shift in the Federal Reserve policy stance was reflected in the Federal Open Market Committee’s (FOMC) November meeting Minutes, which revived the US Dollar sellers while the US Treasury bond yields also suffered alongside. The US Federal Reserve Minutes showed on Wednesday that policymakers saw a slower pace of tightening appropriate “soon”. Markets almost confirmed a 50 basis points (bps) rate increase by the Federal Reserve for the next month.

The US Dollar’s pain was also exacerbated by a slew of discouraging economic data from the United States published ahead of Thanksgiving Day. The United States preliminary S&P Global Composite PMI Output Index, which tracks the manufacturing and services sectors, fell to 46.3 this month from a final reading of 48.2 in October, signaling heightened recession risks in the world’s largest economy. The US weekly Initial Jobless Claims hit three-month highs of 240K, in the face of rising layoffs in the United States technology sector. Markets ignored the 1% jump in the US Durable Goods Orders data, as they see a slowdown in the American economy as inevitable.

Further, Thanksgiving Day-induced thin trading conditions followed by a partial holiday on Black Friday allowed the Pound Sterling buyers to have an upper hand over the US Dollar bulls. Federal Reserve policymakers also voiced their support for slower rate increments during their appearance throughout the week, rendering US Dollar negative.

On the British Pound side of the story, Brexit headlines once again came to the fore after Bloomberg reported that the United Kingdom Prime Minister Rishi Sunak is starting to have second thoughts about Brexit even after more than six years of division with the European Union (EU). Some sources reported that UK Finance Minister Jeremy Hunt is said to have privately pushed for Britain to have closer ties with the European Union. Countering the rumors, Prime Minister Rishi Sunak said that Britain will not pursue any post-Brexit relationship with Brussels "that relies on alignment with European Union laws”.

Meanwhile, several Bank of England (BoE) Monetary Policy Committee (MPC) members also took the rostrum, delivering hawkish messages and keeping the Pound Sterling buoyed. Bank of England (BoOE) policymaker Catherine Mann said that “the BoE has communicated effectively that rates need to rise and that market expectations before the November meeting were too high.” Bank of England Deputy Governor Dave Ramsden noted, “my bias is towards further tightening, but depends on the economy.”

Critical United States events to hog the limelight

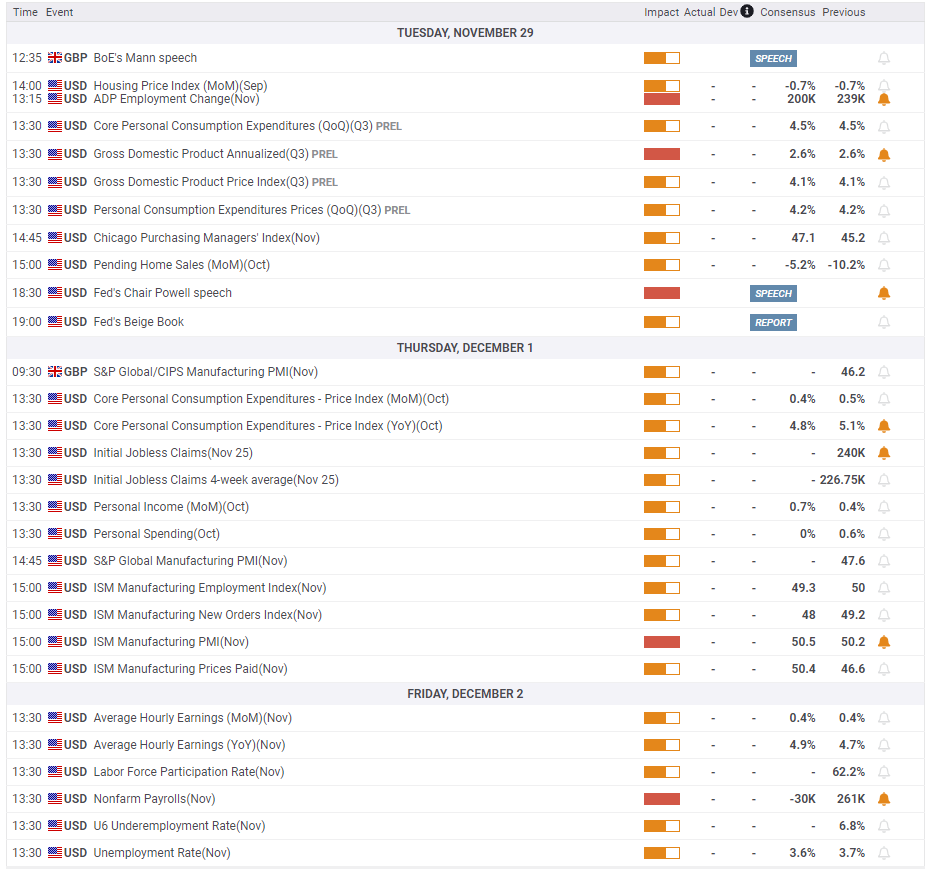

It’s a data-dry week for the United Kingdom, and hence, the high-impactful United States economic data will be closely followed for fresh trading incentives on the GBP/USD pair. Monday is a quiet day on both sides of the Atlantic, except for the speech from New York Fed President John Williams.

On Tuesday, the only meaningful data in the United States will be the release of Conference Board Consumer Confidence in November. Traders will brace for a wholesome Wednesday, with a handful of top-tier macro news on the cards from the United States. The preliminary reading of the US quarterly Gross Domestic Product (GDP) will be published alongside the JOLTS Job Openings and Pending Home Sales data. Ahead of that, the United States ADP Employment Data will also drop in.

However, Federal Reserve Chair Jerome Powell’s speech will steal the spotlight. Jerome Powell is due to speak about the economy and labor market at the Brooking Institution, in Washington DC. His speech will be closely scrutinized ahead of Friday’s Nonfarm Payrolls release.

On Thursday, OPEC and its allies (OPEC+) meeting will grab attention, especially after last week’s oil price volatility and reports of increased OPEC production. The oil price action on the OPEC+ decision could impact the market sentiment, in turn, influencing the risk-sensitive Pound Sterling.

The United States Core PCE Price Index, Weekly Jobless Claims and S&P Global final Manufacturing PMI will be released. But the US ISM Manufacturing PMI and the prices paid component will hold the key for the US Dollar trades.

The US labor market report will stand out on Friday, which will provide fresh insights on the Federal Reserve’s future policy course.

GBP/USD: Technical outlook

GBP/USD’s daily chart technical setup favors bulls. The pair’s price has now broken well above the key September highs, in the mid 1.1730s, and thus established a new rising sequence of peaks and troughs suggesting the start of a new broad uptrend. A further break and daily close above the critical 200-Daily Moving Average (DMA) at 1.2185 would seal the deal for Pound Sterling bulls.,

Acceptance above the latter would probably then lead to a test of the horizontal trendline resistance connecting the August 10 high at 1.2276. The next relevant upside target is seen around the 1.2400 round number.

The 14-day Relative Strength Index (RSI) has turned flat while above the midline, suggesting that bulls are gathering strength for a big break higher. Further, the 21 and 100-Daily Moving Average (DMA) bullish crossover remains in play, providing credence to the bullish potential.

Alternatively, any retracement will test a strong resistance-turned-support at 1.2000, a break below which could trigger a corrective decline toward the recent range lows at around 1.1770. The last line of defense for GBP/USD buyers is in the lower 1.1700s, where the September highs, the 21 and the 100 DMAs are located. A break below these would cast the nascent uptrend into doubt.

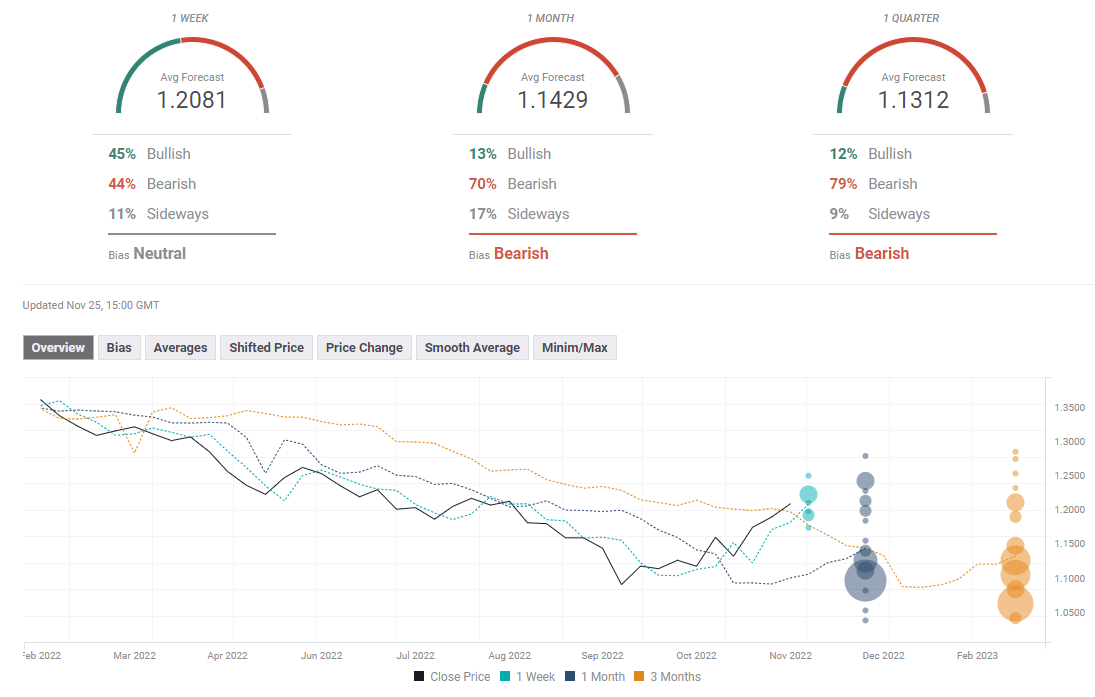

GBP/USD forecast poll

Despite GBP/USD relatively upbeat performance in the past few weeks, the FXStreet Forecast Poll shows that the majority of experts see the pair suffering large losses on a one-month and one-quarter views. For these time frames, average targets align at 1.1429 and 1.1312, respectively.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.