Crude Oil Started With Crash

Photo by Timothy Newman on Unsplash

Crude oil market started the new week with sales. A Brent barrel is falling to 81.40 USD.

The worst of the news comes from China. The Chinese are rebelling against tough anti-coronavirus measures and lockdowns imposed by the government due to many new cases of COVID-19. The situation generates points of uncertainty because it is yet unclear how the Chinese authorities will react and how it all ends.

The issue with the maximum price level for Russian oil also keeps the market nervous. According to Baker Hughes, the number of active oil rigs in the US increased last week by 4, reaching 627.

On H4, Brent has completed a wave of decline to 81.05. Today a consolidation range may form around it. With an escape upwards, a correction link to 89.09 might form. Then a link of decline to 78.78 and even 78.25 becomes possible. Technically, this scenario is confirmed by the MACD. Its signal line is at lows, preparing to grow to zero.

(Click on image to enlarge)

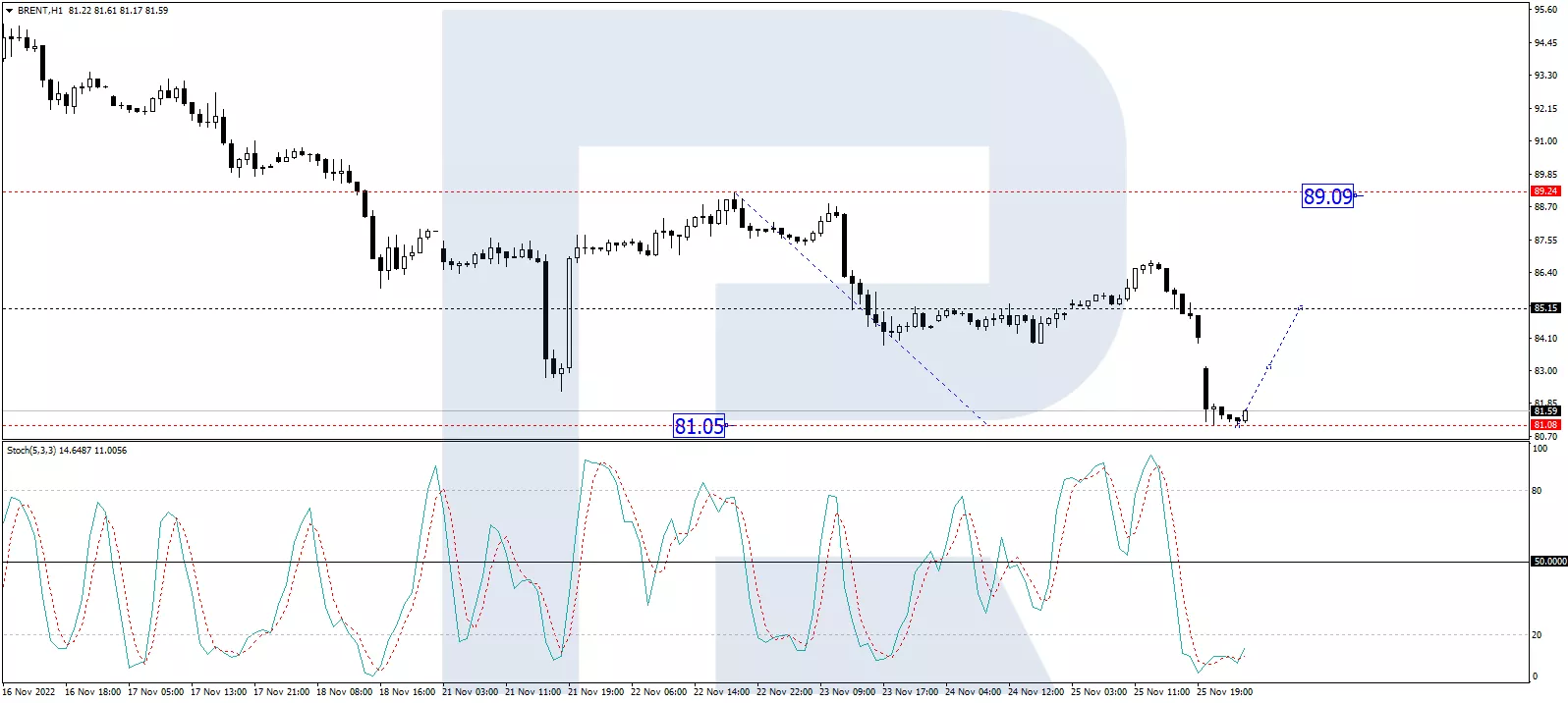

On H1, Brent has formed a consolidation range of around 85.00. Today with an escape downwards, a local goal of the declining wave has been reached at 81.05. With an escape upwards, a pathway up to 85.00 will open (a test from below). Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is under 20, headed straight upwards. The indicator is expected to grow to 50.

(Click on image to enlarge)

More By This Author:

Crude Oil Inclined Down

Euro Sky-Rocketed To Four Months Highs

Crude Oil Grew Confidently

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more