Top 20 Highest-Yielding Dividend Aristocrats Now, Yields Up To 6.3%

At Sure Dividend, we often steer income investors toward the Dividend Aristocrats. Investors looking for high-quality dividend stocks to buy and hold for the long run can find many attractive stocks on this prestigious list.

The Dividend Aristocrats are a select group of 65 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

We typically rank stocks based on their five-year expected annual returns, as stated in the Sure Analysis Research Database.

But for investors primarily interested in income, it is also useful to rank the Dividend Aristocrats according to their dividend yields.

This article will rank the 20 highest-yielding Dividend Aristocrats today.

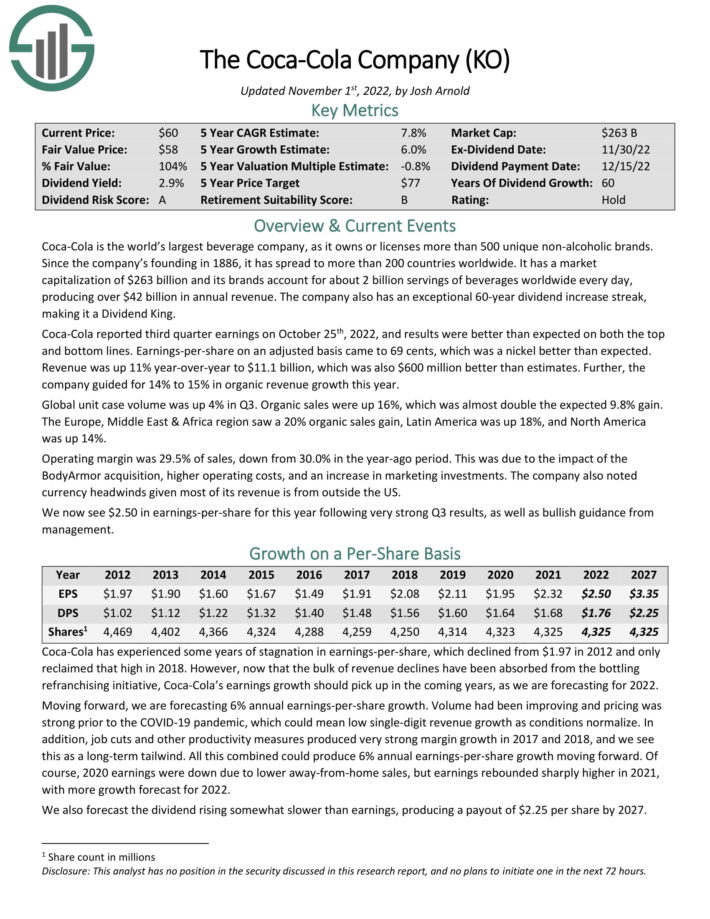

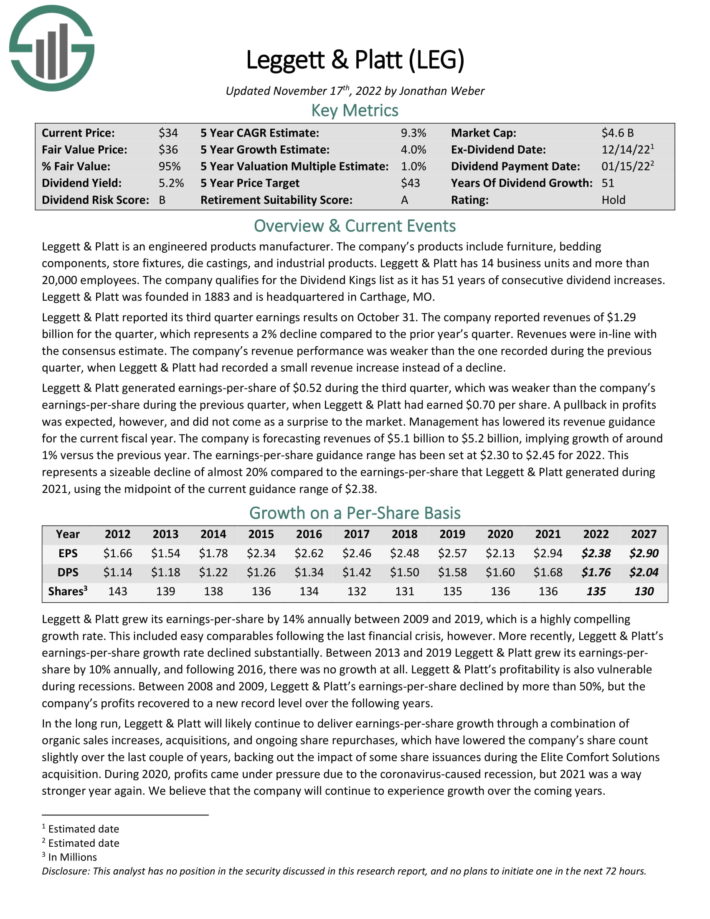

High Yield Dividend Aristocrat #20: The Coca-Cola Company (KO)

- Dividend Yield: 2.8%

Coca-Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

Source: Investor Presentation

The company also has an exceptional 59-year dividend increase streak.

As a major holding of Berkshire Hathaway’s investment portfolio, Coca-Cola is a Warren Buffett stock.

Coca-Cola reported third-quarter earnings on October 25th, 2022, and results were better than expected on both the top and bottom lines. Earnings-per-share on an adjusted basis came to 69 cents, which was a nickel better than expected.

Revenue was up 11% year-over-year to $11.1 billion, which was also $600 million better than estimates. Further, the company guided for 14% to 15% in organic revenue growth this year.

Global unit case volume was up 4% in Q3. Organic sales were up 16%, which was almost double the expected 9.8% gain. Europe, Middle East & Africa regions saw a 20% organic sales gain, Latin America was up 18%, and North America was up 14%.

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

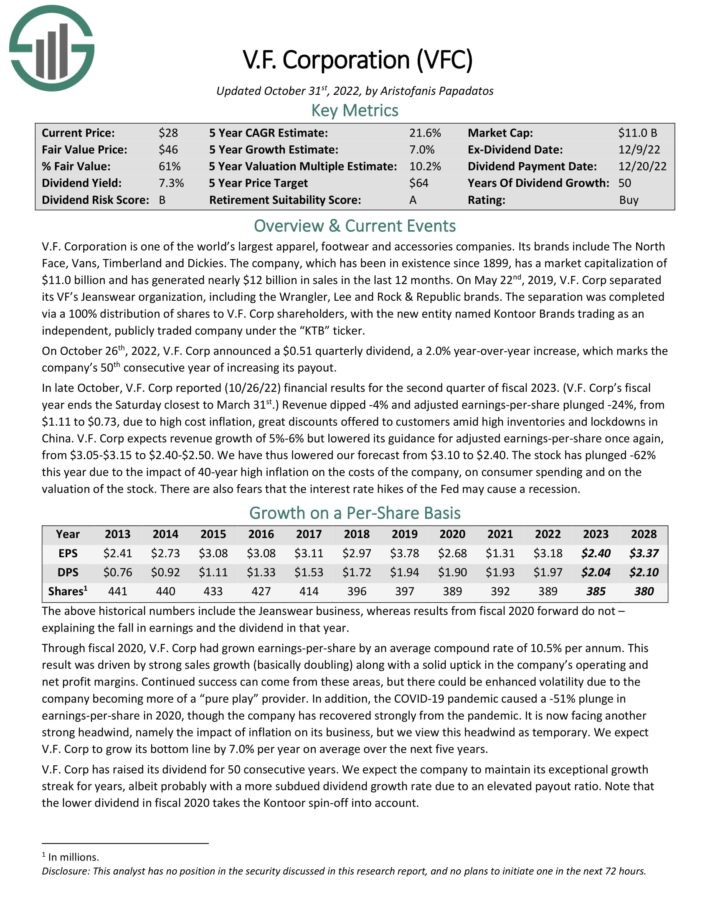

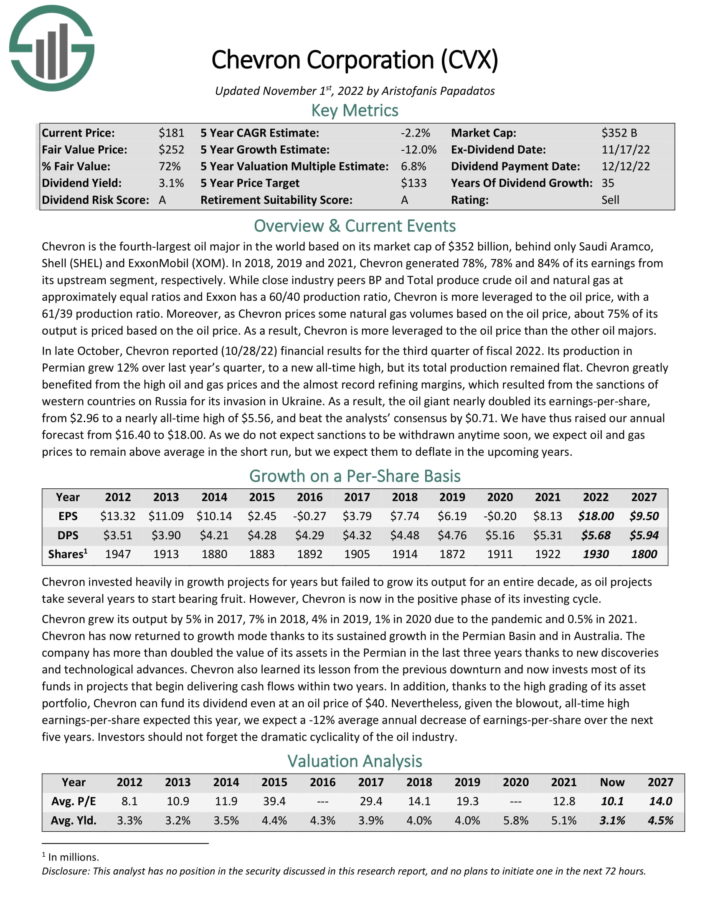

High Yield Dividend Aristocrat #19: Chevron Corporation (CVX)

- Dividend Yield: 3.1%

Chevron is the third–largest oil major in the world. In 2021, Chevron generated 84% of its earnings from its upstream segment. The company has increased its dividend for over 40 consecutive years.

In late October, Chevron reported (10/28/22) financial results for the third quarter of fiscal 2022. Its production in the Permian grew 12% over last year’s quarter, to a new all-time high, but its total production remained flat. Chevron greatly benefited from the high oil and gas prices and the almost record refining margins, which resulted from the sanctions of western countries on Russia for its invasion of Ukraine.

As a result, the oil giant nearly doubled its earnings-per-share, from $2.96 to a nearly all-time high of $5.56, and beat the analysts’ consensus by $0.71.

Source: Investor Presentation

Chevron is a Dividend Aristocrat with over 40 consecutive years of dividend increases.

Click here to download our most recent Sure Analysis report on CVX (preview of page 1 of 3 shown below):

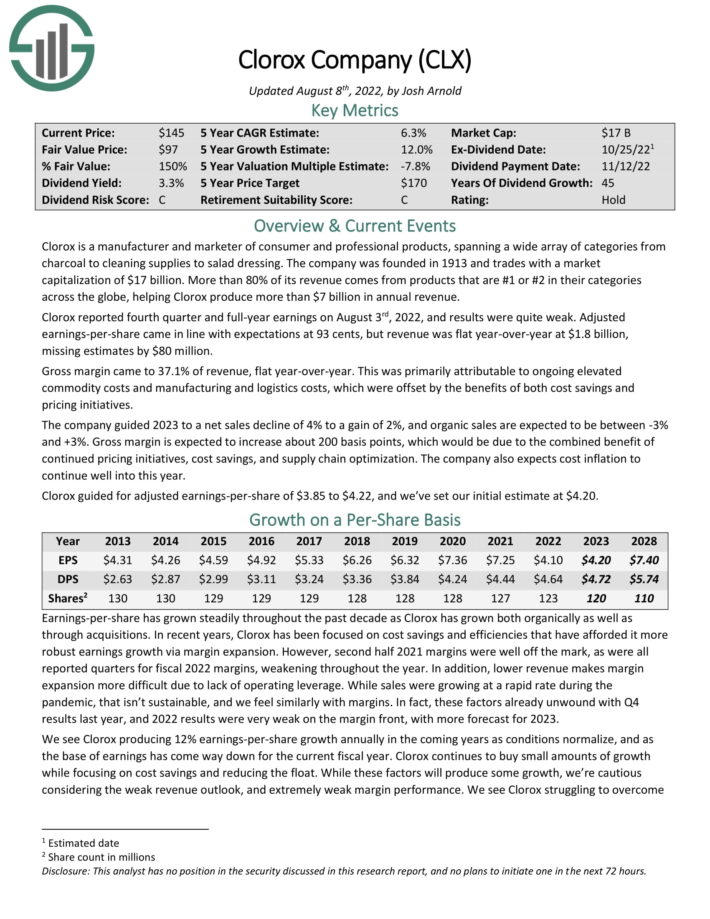

High Yield Dividend Aristocrat #18: The Clorox Company (CLX)

- Dividend Yield: 3.2%

The Clorox Company is a manufacturer and marketer of consumer and professional products, spanning a wide array of categories from charcoal to cleaning supplies to salad dressing. More than 80% of its revenue comes from products that are #1 or #2 in their categories across the globe, helping Clorox produce more than $7 billion in annual revenue.

Source: Investor Presentation

Clorox reported fourth-quarter and full-year earnings on August 3rd, 2022, and the results were quite weak. Adjusted earnings-per-share came in line with expectations at 93 cents, but revenue was flat year-over-year at $1.8 billion, missing estimates by $80 million.

Gross margin came to 37.1% of revenue, flat year-over-year. This was primarily attributable to ongoing elevated commodity costs and manufacturing and logistics costs, which were offset by the benefits of both cost savings and pricing initiatives.

The company guided 2023 to a net sales decline of 4% to a gain of 2%, and organic sales are expected to be between -3% and +3%. Gross margin is expected to increase by about 200 basis points, which would be due to the combined benefit of continued pricing initiatives, cost savings, and supply chain optimization. The company also expects cost inflation to continue well into this year. Clorox guided for adjusted earnings-per-share of $3.85 to $4.22.

Click here to download our most recent Sure Analysis report on Clorox (preview of page 1 of 3 shown below):

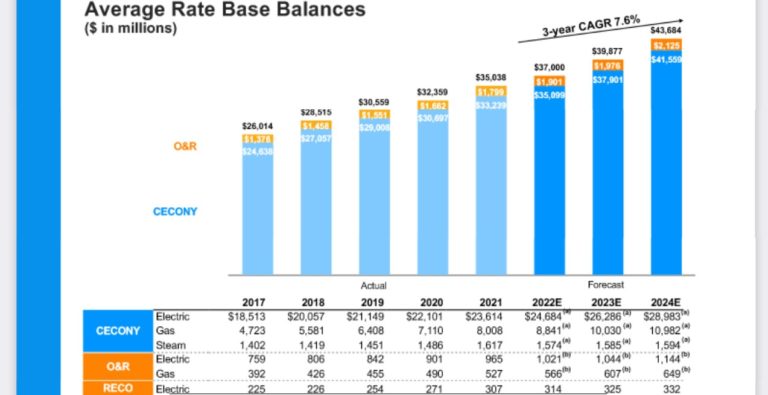

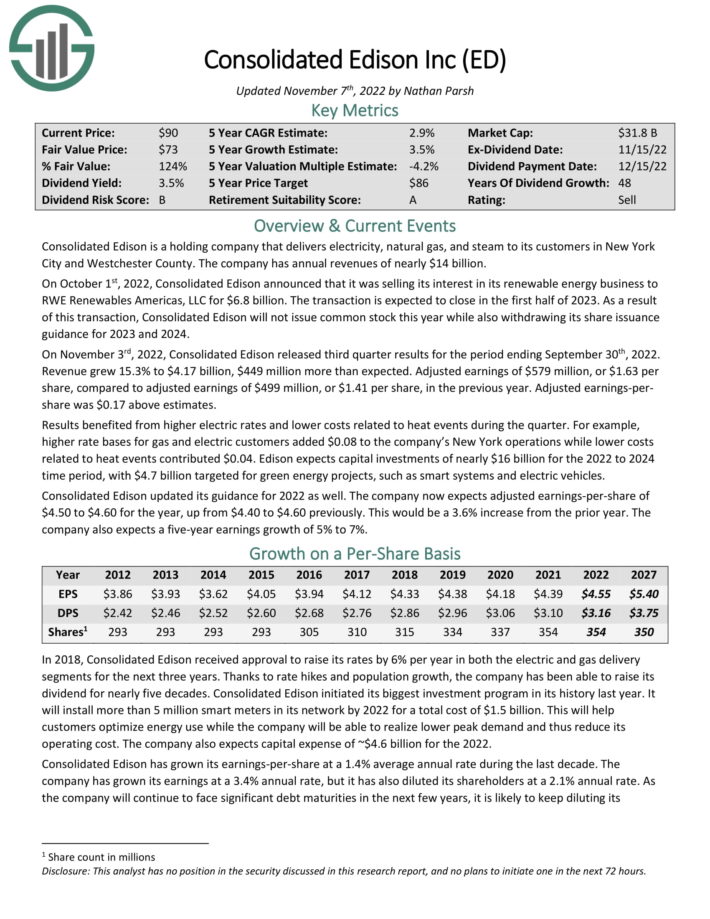

High Yield Dividend Aristocrat #17: Consolidated Edison (ED)

- Dividend Yield: 3.3%

Consolidated Edison is a holding company that delivers electricity, natural gas, and steam to its customers in New York City and Westchester County. It has annual revenues of nearly $13 billion.

On November 3rd, 2022, Consolidated Edison released third-quarter results for the period ending September 30th, 2022. Revenue grew 15.3% to $4.17 billion, $449 million more than expected. Adjusted earnings of $579 million, or $1.63 per share, compared to adjusted earnings of $499 million, or $1.41 per share, in the previous year. Adjusted earnings-per-share was $0.17 above estimates.

Results benefited from higher electric rates and lower costs related to heat events during the quarter. For example, higher rate bases for gas and electric customers added $0.08 to the company’s New York operations while lower costs related to heat events contributed $0.04. Edison expects capital investments of nearly $16 billion for the 2022 to 2024 time period, with $4.7 billion targeted for green energy projects, such as smart systems and electric vehicles.

Consolidated Edison updated its guidance for 2022 as well. The company now expects adjusted earnings-per-share of $4.50 to $4.60 for the year, up from $4.40 to $4.60 previously. This would be a 3.6% increase from the prior year. The company also expects a five-year earnings growth of 5% to 7%.

Rate increases are a major driver of Consolidated Edison’s growth.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on ConEd (preview of page 1 of 3 shown below):

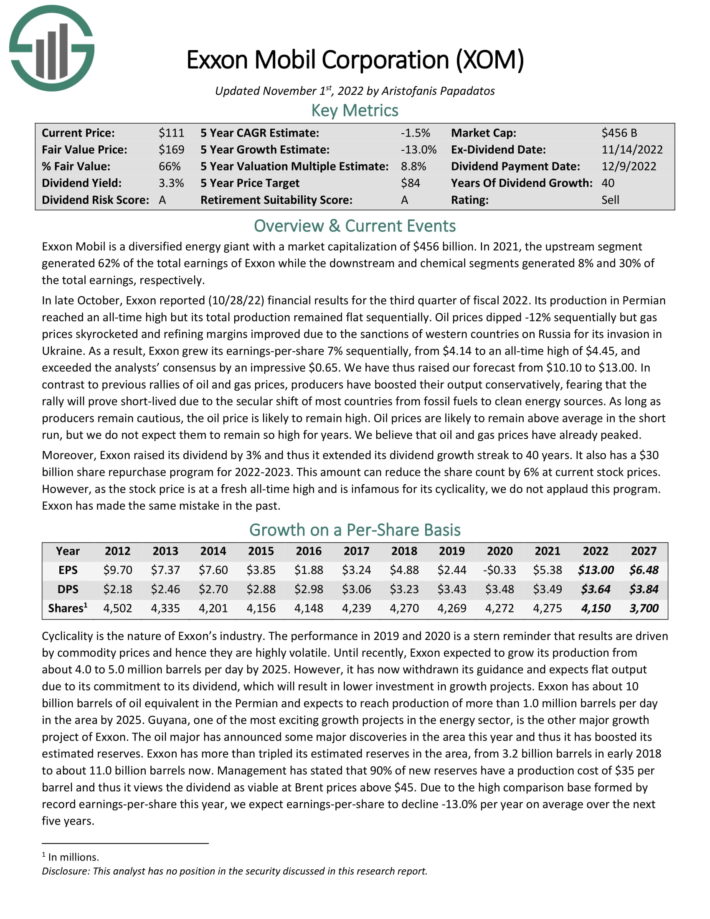

High Yield Dividend Aristocrat #16: ExxonMobil Corporation (XOM)

- Dividend Yield: 3.3%

Exxon Mobil is a diversified energy giant with a market capitalization above $300 billion. In 2021, the upstream segment generated 62% of its total earnings of Exxon while the downstream and chemical segments generated 8% and 30% of the total earnings, respectively.

In late October, Exxon reported (10/28/22) financial results for the third quarter of fiscal 2022. Its production in the Permian reached an all-time high but its total production remained flat sequentially. Oil prices dipped 12% sequentially but gas prices skyrocketed and refining margins improved due to the sanctions of western countries on Russia for its invasion of Ukraine. As a result, Exxon grew its earnings-per-share 7% sequentially, from $4.14 to an all-time high of $4.45, and exceeded the analysts’ consensus by $0.65.

Moreover, Exxon raised its dividend by 3% and thus it extended its dividend growth streak to 40 years. It also has a $30 billion share repurchase program for 2022-2023.

Click here to download our most recent Sure Analysis report on Exxon Mobil (preview of page 1 of 3 shown below):

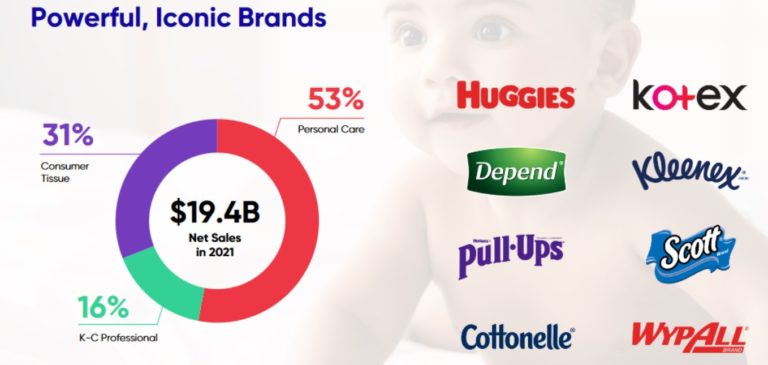

High Yield Dividend Aristocrat #15: Kimberly-Clark (KMB)

- Dividend Yield: 3.5%

Kimberly-Clark is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates through two segments that each house many popular brands: Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise) and the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), generating nearly $20 billion in annual revenue.

Source: Investor Presentation

Kimberly-Clark reported third-quarter earnings on October 25th, 2022, and the results were mixed. The company beat expectations on the top line, with revenue hitting $5.05 billion. That was up 0.8% year-over-year and beat estimates by $40 million. However, adjusted earnings-per-share came to $1.40, which was five cents lower than expectations.

The company saw a 9% gain from higher selling prices in the third quarter, which was driven by the need to recoup costs from inflationary pressures. That was offset by lower volumes.

Click here to download our most recent Sure Analysis report on Kimberly-Clark (preview of page 1 of 3 shown below):

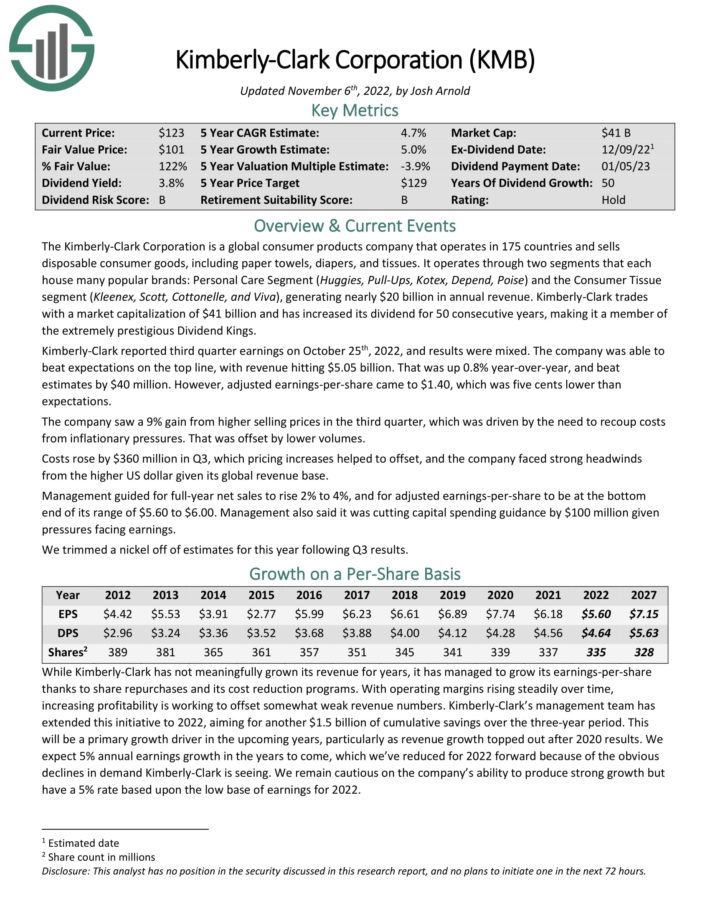

High Yield Dividend Aristocrat #14: Medtronic plc (MDT)

- Dividend Yield: 3.6%

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. The company serves physicians, hospitals, and patients in more than 150.

Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience, and Diabetes. It has a strong product pipeline to fuel its future growth.

Source: Investor Presentation

Medtronic has raised its dividend for 45 consecutive years. The company generated $32 billion in revenue in its last fiscal year.

In May 2022, Medtronic raised its dividend to $0.68 per share; the company’s 45th consecutive yearly increase.

In late November, Medtronic reported (11/22/22) results for the second quarter of the fiscal year 2023. Organic revenue grew 2% over last year’s quarter but revenue dipped -3% and earnings-per-share fell -2% due to a strong dollar. Results were hurt by slow supply recovery and modest market procedure volumes in some businesses.

Medtronic lowered its guidance for annual earnings-per-share from $5.53-$5.65 to $5.25-$5.30.

Click here to download our most recent Sure Analysis report on MDT (preview of page 1 of 3 shown below):

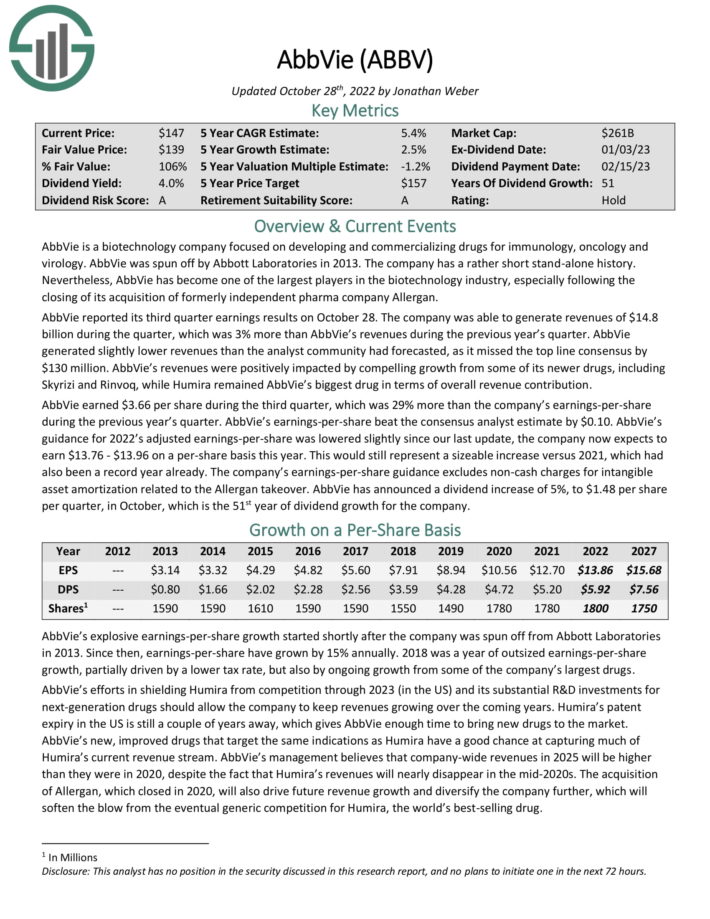

High Yield Dividend Aristocrat #13: AbbVie Inc. (ABBV)

- Dividend Yield: 3.7%

AbbVie Inc. is a pharmaceutical company spun off by Abbott Laboratories (ABT) in 2013. Its most important product is Humira, which is now facing biosimilar competition in Europe, which has had a noticeable impact on the company. Humira will lose patent protection in the U.S. in 2023.

Even so, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

AbbVie reported its third-quarter earnings results on October 28. Revenues of $14.8 billion which was 3% more than AbbVie’s revenues during the previous year’s quarter. Revenue missed consensus by $130 million. Revenues were positively impacted by compelling growth from some of its newer drugs, including Skyrizi and Rinvoq, while Humira remained AbbVie’s biggest drug in terms of overall revenue contribution.

AbbVie earned $3.66 per share during the third quarter, which was 29% more than the company’s earnings-per-share during the previous year’s quarter. AbbVie’s earnings-per-share beat the consensus analyst estimate by $0.10. AbbVie’s guidance for 2022’s adjusted earnings-per-share was lowered slightly since our last update, the company now expects to earn $13.76 – $13.96 on a per-share basis this year.

Click here to download our most recent Sure Analysis report on AbbVie (preview of page 1 of 3 shown below):

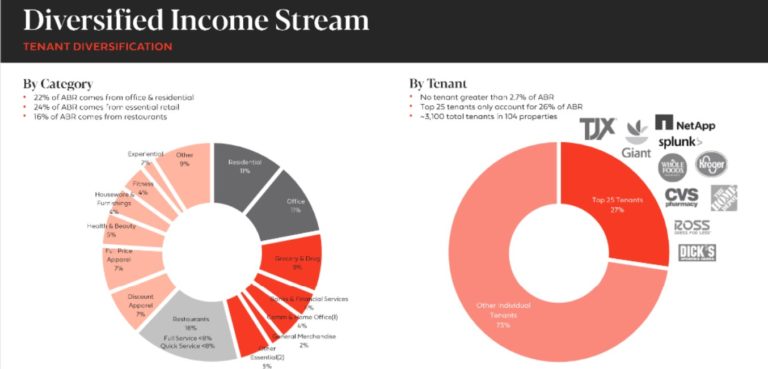

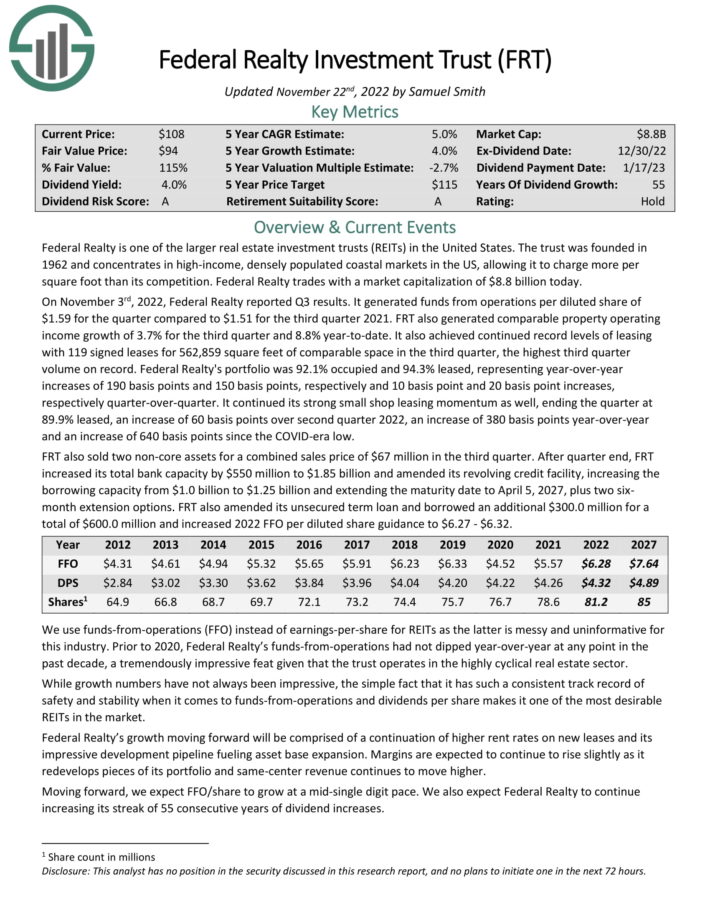

High Yield Dividend Aristocrat #12: Federal Realty Investment Trust (FRT)

- Dividend Yield: 3.9%

Federal Realty was founded in 1962. As a Real Estate Investment Trust, Federal Realty’s business model is to own and rent out real estate properties. It uses a significant portion of its rental income, as well as external financing, to acquire new properties. This helps create a “snowball” effect of rising income over time.

Federal Realty primarily owns shopping centers. However, it also operates in the redevelopment of multi-purpose properties including retail, apartments, and condominiums. The portfolio is highly diversified in terms of the tenant base.

Source: Investor Presentation

On November 3rd, 2022, Federal Realty reported Q3 results. It generated funds from operations per diluted share of $1.59 for the quarter compared to $1.51 for the third quarter of 2021. FRT also generated comparable property operating income growth of 3.7% for the third quarter and 8.8% year-to-date.

It also achieved continued record levels of leasing with 119 signed leases for 562,859 square feet of comparable space in the third quarter, the highest third-quarter volume on record. Federal Realty’s portfolio was 92.1% occupied and 94.3% leased, representing year-over-year increases of 190 basis points and 150 basis points, respectively, and 10 basis point and 20 basis point increase, respectively quarter-over-quarter.

Click here to download our most recent Sure Analysis report on Federal Realty (preview of page 1 of 3 shown below):

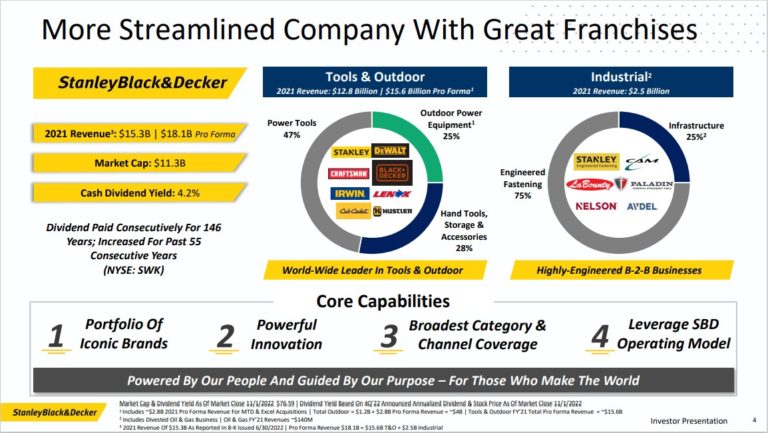

High Yield Dividend Aristocrat #11: Stanley Black & Decker (SWK)

- Dividend Yield: 4.0%

Stanley Black & Decker is a world leader in power tools, hand tools, and related items. The company holds the top global position in tools and storage sales. Stanley Black & Decker is second in the world in the areas of commercial electronic security and engineered fastening.

Source: Investor Presentation

On July 20th, 2022, Stanley Black & Decker raised its quarterly dividend by 1.3% to $0.80, extending the company’s dividend growth streak to 55 consecutive years.

On October 27th, 2022, Stanley Black & Decker announced third quarter results for the period ending September 30th, 2022. Revenue grew 9% to $4.1 billion, topping estimates by $120 million. Adjusted earnings-per-share of $0.76 compared very unfavorably to $2.77 in the prior year but was $0.06 above expectations.

Organic growth declined by 2%. Sales for Tools & Outdoor, the largest segment within the company, experienced an organic decline of 5% as a 7% benefit from pricing was once again more than offset by a decline in volume. North America fell 4% and both emerging markets and Europe were lower by 2%.

Click here to download our most recent Sure Analysis report on SWK (preview of page 1 of 3 shown below):

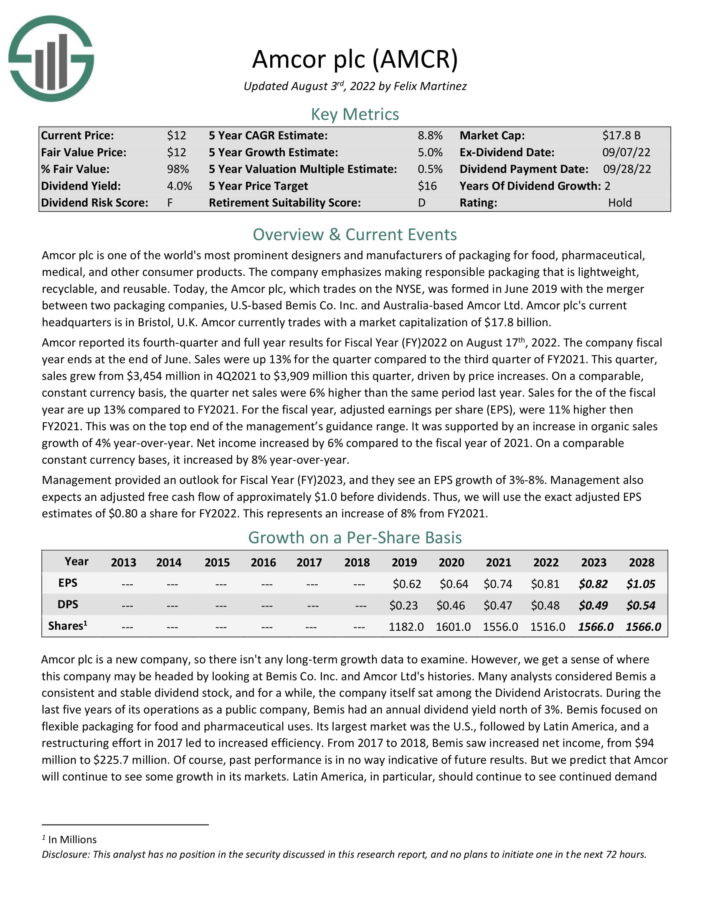

High Yield Dividend Aristocrat #10: Amcor plc (AMCR)

- Dividend Yield: 4.0%

Amcor is one of the world’s most prominent designers and manufacturers of packaging for food, pharmaceutical, medical, and other consumer products. The company is headquartered in the U.K.

Amcor reported its fourth-quarter and full-year results for the Fiscal Year (FY)2022 on August 17th, 2022. The company's fiscal year ends at the end of June. Sales were up 13% for the quarter compared to the third quarter of FY2021. This quarter, sales grew from $3,454 million in 4Q2021 to $3,909 million this quarter, driven by price increases.

On a comparable, constant currency basis, the quarter net sales were 6% higher than in the same period last year. Sales for the fiscal year are up 13% compared to FY2021.

For the fiscal year, adjusted earnings per share (EPS), were 11% higher than in FY2021. This was on the top end of the management’s guidance range. It was supported by an increase in organic sales growth of 4% year-over-year. Net income increased by 6% compared to the fiscal year of 2021. On comparable constant currency bases, it increased by 8% year-over-year.

Management provided an outlook for the Fiscal Year (FY) 2023, and they see an EPS growth of 3%-8%.

Click here to download our most recent Sure Analysis report on Amcor (preview of page 1 of 3 shown below):

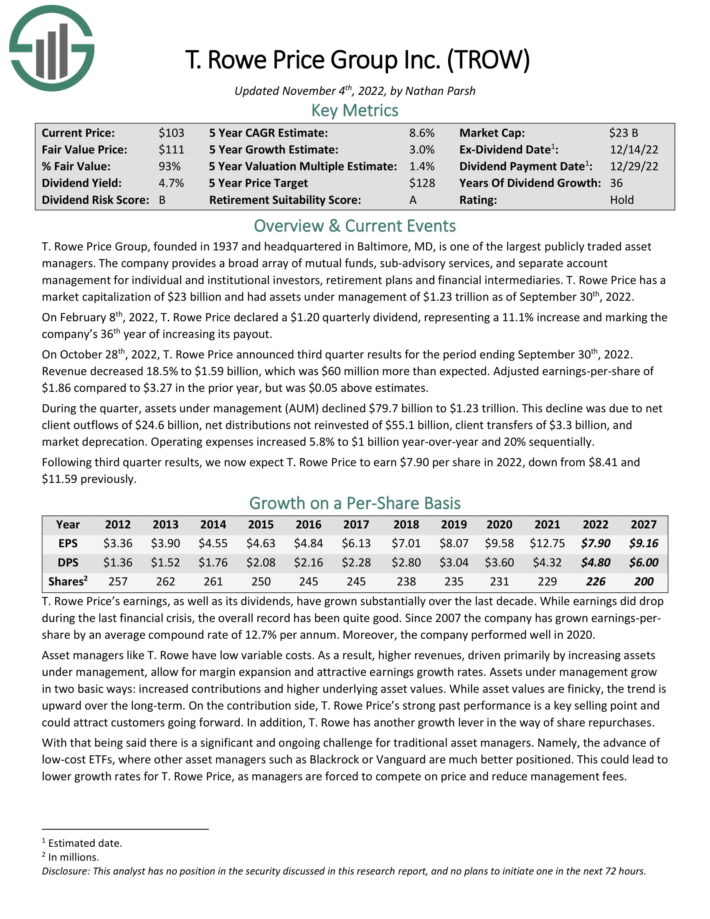

High Yield Dividend Aristocrat #9: T. Rowe Price Group (TROW)

- Dividend Yield: 4.0%

T. Rowe Price Group is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, sub-advisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries.

On October 28th, 2022, T. Rowe Price announced third quarter results for the period ending September 30th, 2022. Revenue decreased by 18.5% to $1.59 billion, which was $60 million more than expected. Adjusted earnings-per-share of $1.86 compared to $3.27 in the prior year but was $0.05 above estimates.

During the quarter, assets under management (AUM) declined from $79.7 billion to $1.23 trillion. This decline was due to net client outflows of $24.6 billion, net distributions not reinvested of $55.1 billion, client transfers of $3.3 billion, and market deprecation. Operating expenses increased 5.8% to $1 billion year-over-year and 20% sequentially.

Click here to download our most recent Sure Analysis report on TROW (preview of page 1 of 3 shown below):

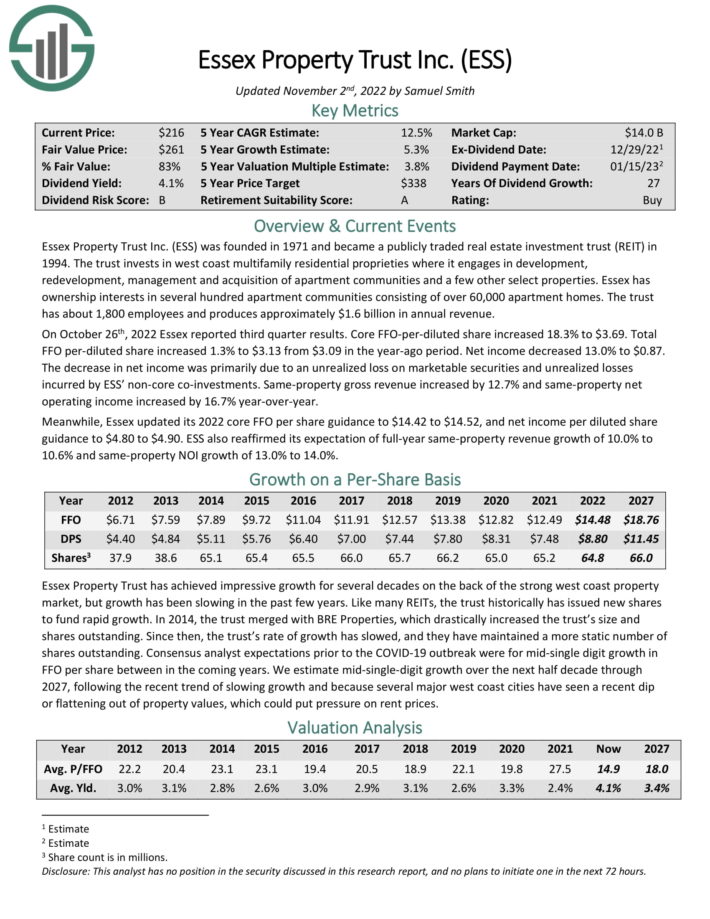

High Yield Dividend Aristocrat #8: Essex Property Trust (ESS)

- Dividend Yield: 4.1%

Essex Property Trust was founded in 1971. The trust invests in west coast multifamily residential proprieties where it engages in the development, redevelopment, management, and acquisition of apartment communities and a few other select properties. Essex has ownership interests in several hundred apartment communities consisting of over 60,000 apartment homes. The trust has about 1,800 employees and produces approximately $1.6 billion in annual revenue.

Source: Investor Presentation

On October 26th, 2022 Essex reported third-quarter results. Core FFO-per-diluted share increased 18.3% to $3.69. Total FFO per diluted share increased 1.3% to $3.13 from $3.09 in the year-ago period. Net income decreased by 13.0% to $0.87.

The decrease in net income was primarily due to an unrealized loss on marketable securities and unrealized losses incurred by ESS’ non-core co-investments. Same-property gross revenue increased by 12.7% and same-property net operating income increased by 16.7% year-over-year.

Meanwhile, Essex updated its 2022 core FFO per share guidance to $14.42 to $14.52, and net income per diluted share guidance to $4.80 to $4.90. ESS also reaffirmed its expectation of full-year same-property revenue growth of 10.0% to 10.6% and same-property NOI growth of 13.0% to 14.0%.

Click here to download our most recent Sure Analysis report on ESS (preview of page 1 of 3 shown below):

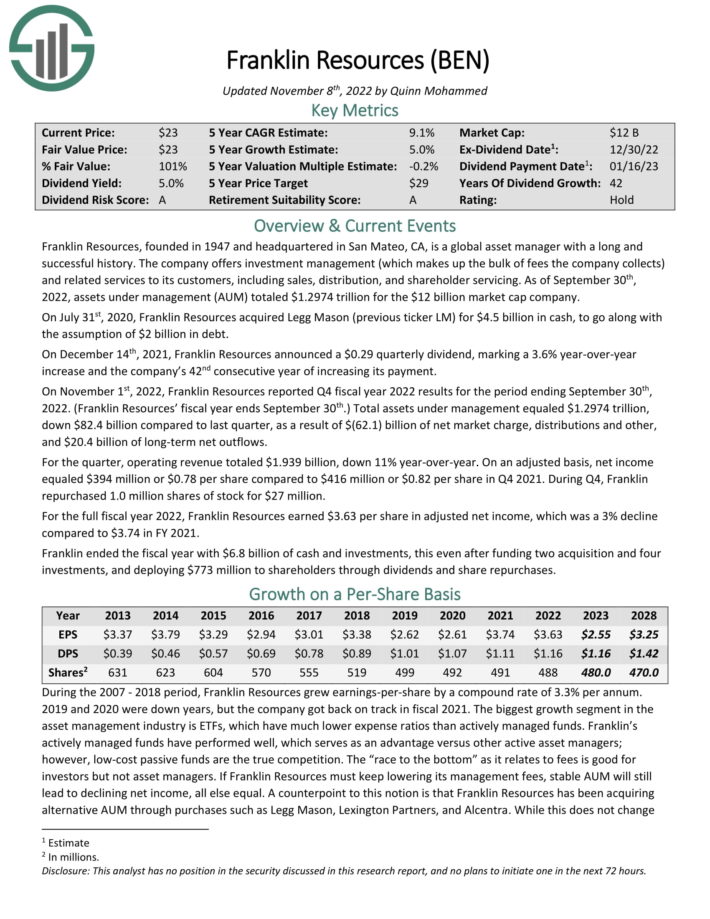

High Yield Dividend Aristocrat #7: Franklin Resources (BEN)

- Dividend Yield: 4.4%

Franklin Resources is a global asset manager with a long and successful history. The company offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

On December 14th, 2021, Franklin Resources announced a $0.29 quarterly dividend, marking a 3.6% year-over-year increase and the company’s 42nd consecutive year of increasing its payment.

On November 1st, 2022, Franklin Resources reported Q4 fiscal year 2022 results for the period ending September 30th, 2022. (Franklin Resources’ fiscal year ends September 30th.) Total assets under management equaled $1.2974 trillion, down $82.4 billion compared to last quarter, as a result of $(62.1) billion of net market charge, distributions, and other, and $20.4 billion of long-term net outflows.

For the quarter, operating revenue totaled $1.939 billion, down 11% year-over-year. On an adjusted basis, net income equaled $394 million or $0.78 per share compared to $416 million or $0.82 per share in Q4 2021. During Q4, Franklin repurchased 1.0 million shares of stock for $27 million.

For the full fiscal year 2022, Franklin Resources earned $3.63 per share in adjusted net income, which was a 3% decline compared to $3.74 in FY 2021.

Click here to download our most recent Sure Analysis report on Franklin Resources (preview of page 1 of 3 shown below):

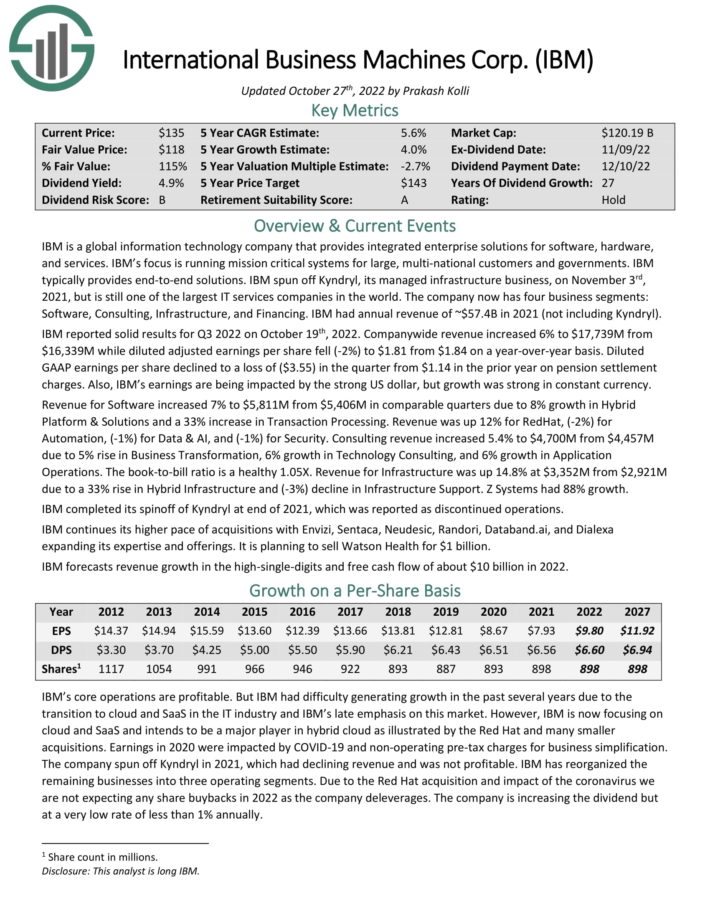

High Yield Dividend Aristocrat #6: International Business Machines (IBM)

- Dividend Yield: 4.5%

IBM is a global information technology company that provides integrated enterprise solutions for software, hardware, and services. IBM’s focus is running mission-critical systems for large, multi-national customers and governments. IBM typically provides end-to-end solutions.

The company now has four business segments: Software, Consulting, Infrastructure, and Financing. IBM had annual revenue of ~$57.4B in 2021 (not including Kyndryl).

IBM reported solid results for Q3 2022 on October 19th, 2022. Company-wide revenue increased 6% to $17,739M from $16,339M while diluted adjusted earnings per share fell (-2%) to $1.81 from $1.84 on a year-over-year basis. Diluted GAAP earnings per share declined to a loss of ($3.55) in the quarter from $1.14 in the prior year on pension settlement charges. Also, IBM’s earnings are being impacted by the strong US dollar, but growth was strong in constant currency.

Revenue for Software increased 7% to $5,811M from $5,406M in comparable quarters due to 8% growth in Hybrid Platform & Solutions and a 33% increase in Transaction Processing. Revenue was up 12% for RedHat, (-2%) for Automation, (-1%) for Data & AI, and (-1%) for Security. Consulting revenue increased by 5.4%.

Click here to download our most recent Sure Analysis report on IBM (preview of page 1 of 3 shown below):

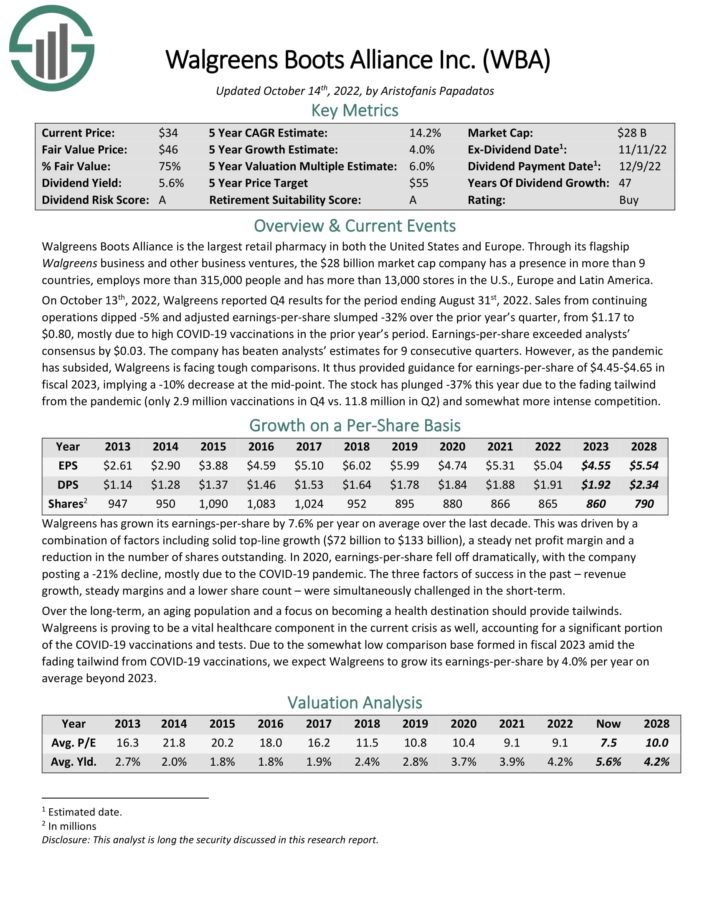

High Yield Dividend Aristocrat #5: Walgreens-Boots Alliance (WBA)

- Dividend Yield: 4.7%

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the company employs more than 325,000 people and has more than 13,000 stores.

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the company employs more than 325,000 people and has more than 13,000 stores.

On October 13th, 2022, Walgreens reported Q4 results for the period ending August 31st, 2022. Sales from continuing operations declined by 5% and adjusted earnings-per-share declined by 32% year-over-year, mostly due to high COVID-19 vaccinations in the prior year period. Earnings-per-share exceeded analysts’ consensus by $0.03. The company has beaten analysts’ estimates for 9 consecutive quarters.

As the pandemic has subsided, Walgreens is facing tough comparisons. It provided guidance for earnings-per-share of $4.45-$4.65 in fiscal 2023, implying a 10% decrease at the mid-point.

Click here to download our most recent Sure Analysis report on Walgreens (preview of page 1 of 3 shown below):

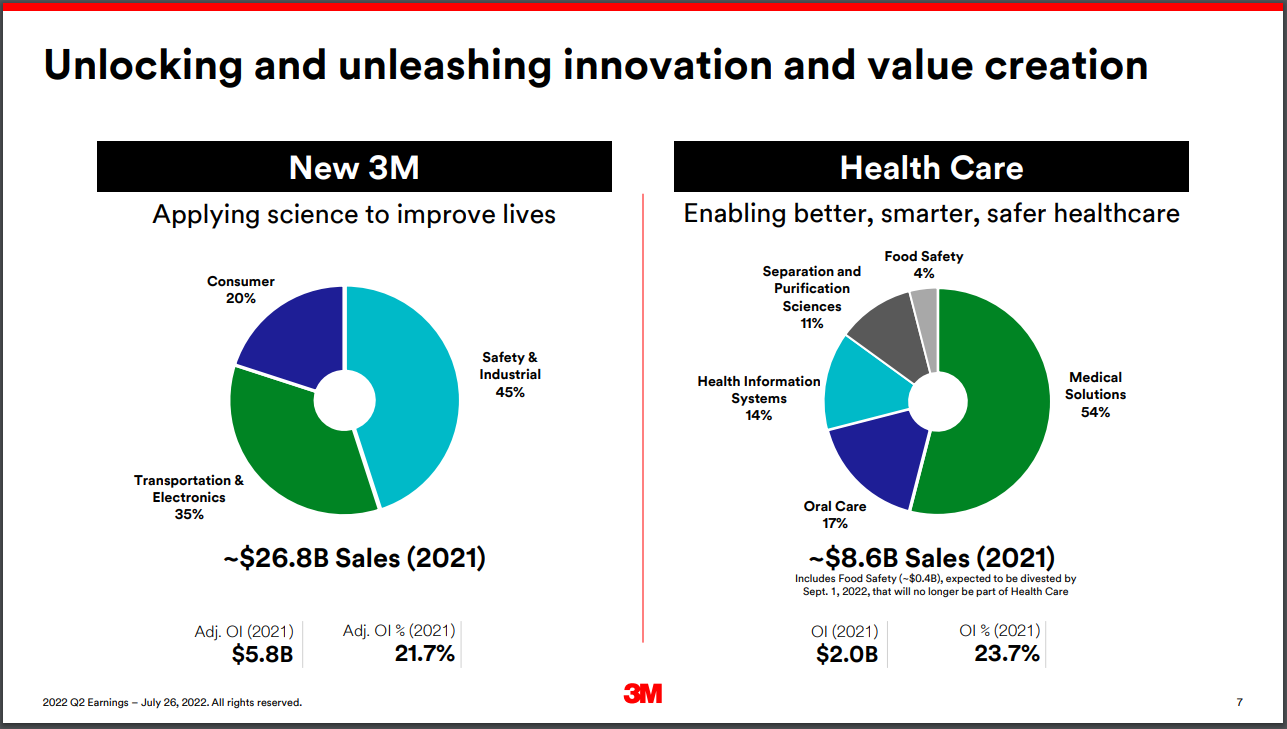

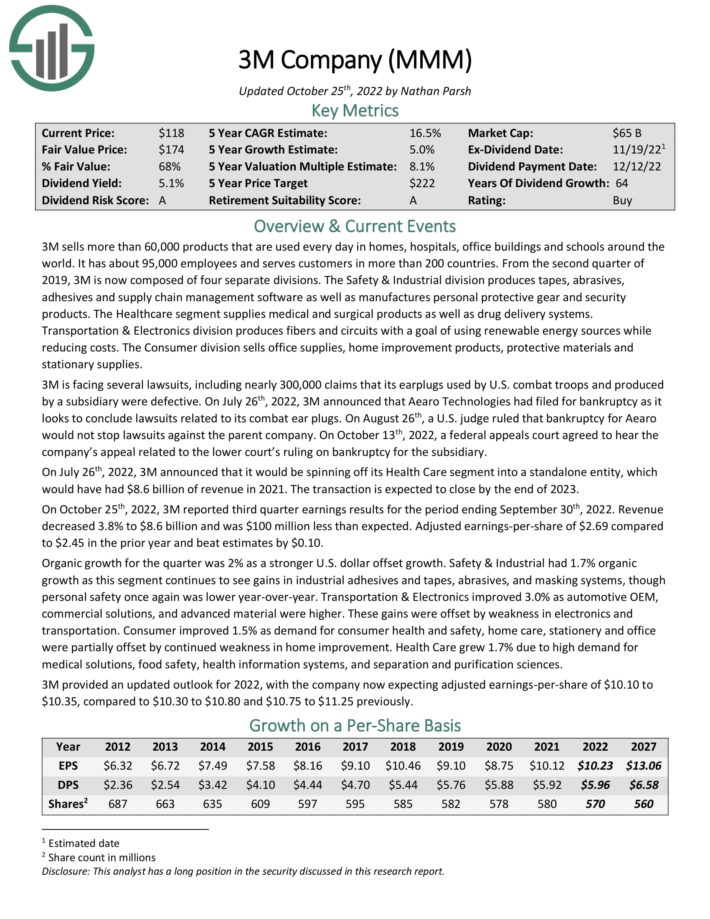

High Yield Dividend Aristocrat #4: 3M Company (MMM)

- Dividend Yield: 4.7%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings, and schools around the world. It has about 95,000 employees and serves customers in more than 200 countries.

On July 26th, the company reported second-quarter results. For the quarter, revenue fell 3% to $8.7 billion. Adjusted EPS declined 10% year-over-year, from $2.75 in Q2 2021 to $2.48 in Q2 2022.

Along with its quarterly results, the company separately announced that it will spin off its healthcare segment. This is a major announcement, as the healthcare business itself generates over $8 billion in annual sales.

Source: Investor Presentation

The company also announced that it would be spinning off its Health Care segment into a standalone entity, which would have had $8.6 billion of revenue in 2021. The transaction is expected to close by the end of 2023.3M provided an updated outlook for 2022, with the company now expecting adjusted earnings-per-share of $10.30 to $10.80 for the year, down from $10.75 to $11.25 previously.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

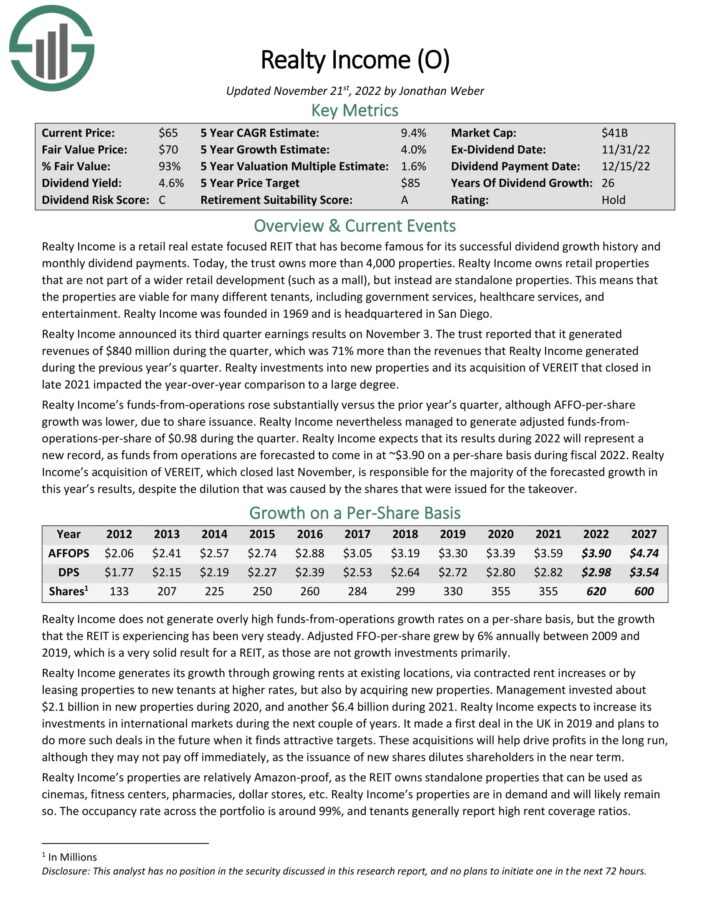

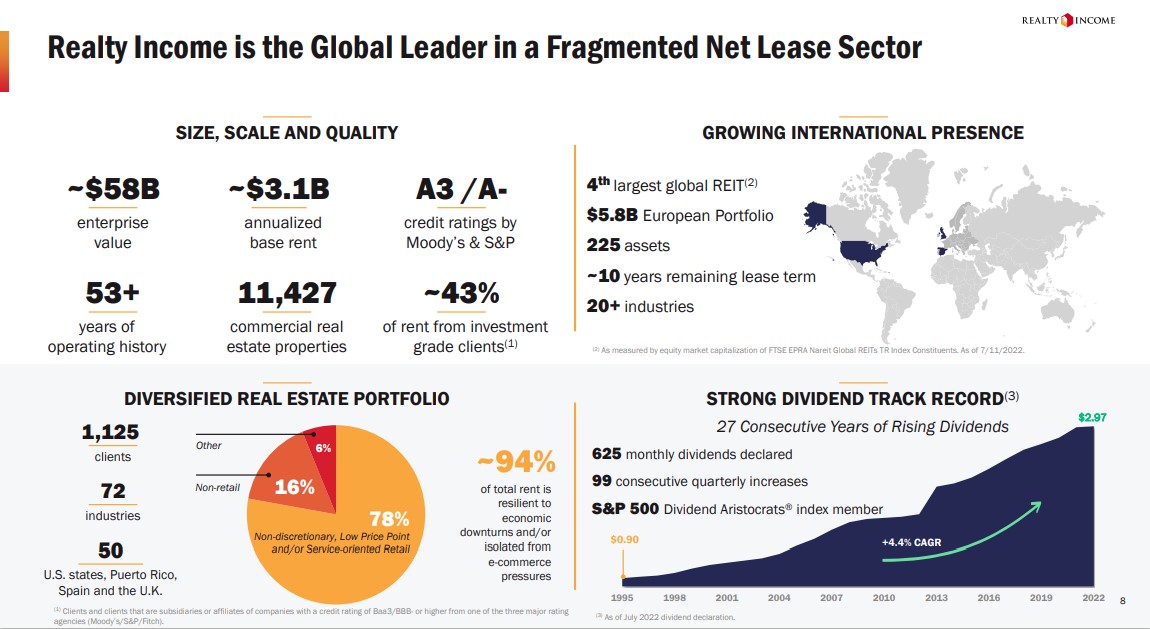

High Yield Dividend Aristocrat #3: Realty Income (O)

- Dividend Yield: 4.8%

Realty Income is a retail-focused REIT that owns more than 6,500 properties. It owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Source: Investor Presentation

The company’s long history of dividend payments and increases is due to its high-quality business model and diversified property portfolio.

Realty Income announced its third-quarter earnings results on November 3. The trust reported that it generated revenues of $840 million during the quarter, which was 71% more than the revenues that Realty Income generated during the previous year’s quarter.

Realty investments into new properties and its acquisition of VEREIT which closed in late 2021 impacted the year-over-year comparison to a large degree. Realty Income’s funds-from-operations rose substantially versus the prior year’s quarter, although AFFO-per-share growth was lower, due to share issuance.

Realty Income nevertheless managed to generate an adjusted FFO-per-share of $0.98 during the quarter. Realty Income expects that its results during 2022 will represent a new record, as funds from operations are forecasted to come in at ~$3.90 on a per-share basis during fiscal 2022.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

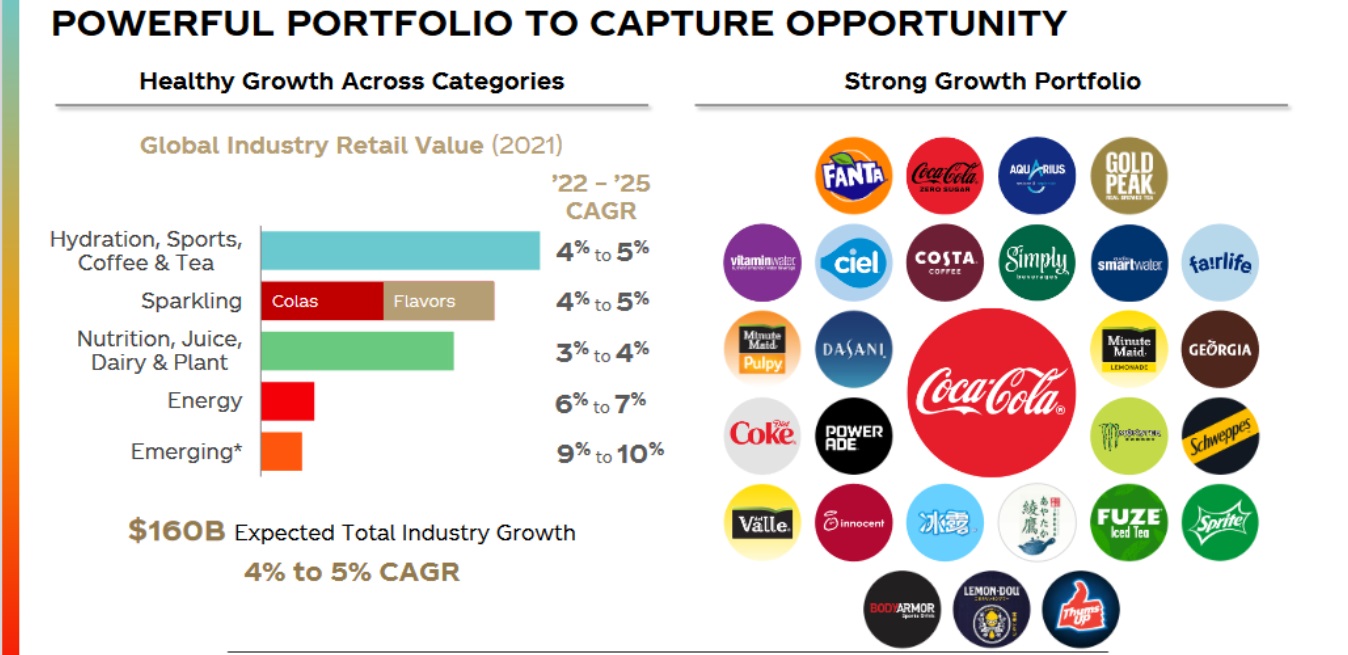

High Yield Dividend Aristocrat #2: Leggett & Platt (LEG)

- Dividend Yield: 5.0%

Leggett & Platt is an engineered products manufacturer. The company’s products include furniture, bedding components, store fixtures, die castings, and industrial products. Leggett & Platt has 14 business units and more than 20,000 employees. The company qualifies for the Dividend Kings as it has 50 years of consecutive dividend increases.

Leggett & Platt reported its third-quarter earnings results on October 31. Revenue of $1.29 billion represented a 2% decline compared to the prior year’s quarter. Revenues were in-line with the consensus estimate. Earnings-per-share of $0.52 during the third quarter, was a sequential decline from $0.70 per share in the previous quarter.

Management also lowered its revenue guidance for the current fiscal year. The company is forecasting revenues of $5.1 billion to $5.2 billion, implying growth of around 1% versus the previous year. The earnings-per-share guidance range has been set at $2.30 to $2.45 for 2022. This represents a sizeable decline of almost 20% compared to 2021, using the midpoint of the current guidance range of $2.38.

Click here to download our most recent Sure Analysis report on Leggett & Platt (preview of page 1 of 3 shown below):

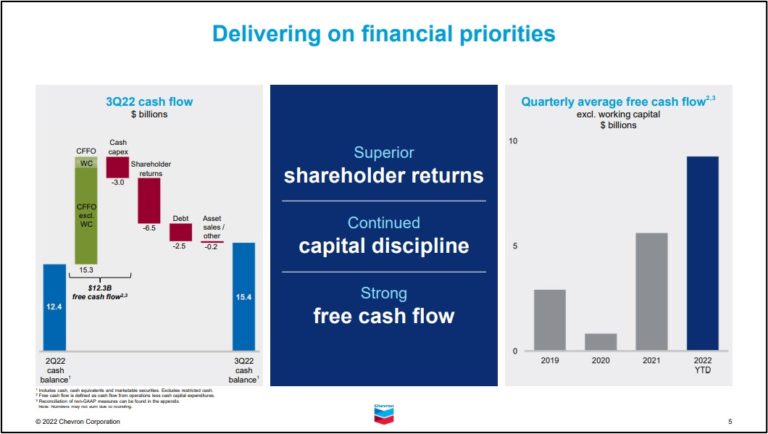

High Yield Dividend Aristocrat #1: V.F. Corp. (VFC)

- Dividend Yield: 6.3%

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland, and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last 12 months.

On October 26th, 2022, V.F. Corp announced a $0.51 quarterly dividend, a 2.0% year-over-year increase, which marks the company’s 50th consecutive year of increasing its payout.

In late October, V.F. Corp reported (10/26/22) financial results for the second quarter of fiscal 2023. (V.F. Corp’s fiscal year ends the Saturday closest to March 31st.) Revenue declined by 4% and adjusted earnings-per-share plunged by 24%, from $1.11 to $0.73. The decline in EPS was due to high-cost inflation, product discounts, and high inventories and lockdowns in China.

V.F. Corp expects revenue growth of 5%-6% but lowered its guidance for adjusted earnings-per-share once again, from $3.05-$3.15 to $2.40-$2.50.

Click here to download our most recent Sure Analysis report on V.F. Corp. (preview of page 1 of 3 shown below):

Final Thoughts

High dividend yields are hard to find in today’s investing climate. The average dividend yield of the S&P 500 Index has steadily fallen over the past decade and is now just 1.5%.

Investors can find significantly higher yields, but many extremely high-yield stocks have questionable business fundamentals. Investors should be wary of stocks with yields above 10%.

Fortunately, investors do not have to sacrifice quality in the search for yield. These 20 Dividend Aristocrats have market-beating dividend yields. But they also have high-quality business models, durable competitive advantages, and long-term growth potential.

You may also be looking to invest in dividend growth stocks with high probabilities of continuing to raise their dividends each year into the future.

More By This Author:

3 Wide Moat Dividend Stocks To Buy Now

The Best Lithium Stocks Now

Warren Buffett Stocks: Louisiana-Pacific Corporation