Putting Carbon Back In The Ground

Dinner in late 2017 with Enlink’s (ENLC) soon to be CEO Mike Garberding and his management team was the most expensive I’ve ever had. Not because I had to pick up the check – they were gracious hosts. But because I left the restaurant impressed with Garberding’s grasp of the company’s opportunities and knowledge of the business. The result was we stayed invested in Enlink during Garberding’s time as CEO from January 2018 to August 2019, when it lost half its value.

Sometimes a careful, dispassionate analysis of a company’s SEC filings can tell you everything you need to know. Calls with management can improve your understanding but can also color your judgment. Eventually former CEO Barry Davis was pulled out of retirement to right the ship.

That was five years ago, and today Enlink is a different story. CEO Barry Davis retired (again) in the summer and was replaced by Jesse Arenivas who joined from Kinder Morgan where he ran their CO2 division. Enhanced Oil Recovery (EOR) used to be the energy sector’s main use for CO2, pumping it into mature oil wells to force out more crude oil. If the CO2 is permanently sequestered underground, it even earns a tax credit under Section 45Q of the tax code..

The recently passed Inflation Reduction Act (IRA) raised this credit to $60 per Metric Tonne (MT). Tax credits for producing crude oil may strike some as not consistent with reducing emissions, but the 45Q credits are turning out to be an important tool. The IRA raised the credit for CO2 captured from industrial processes $85. Capturing CO2 from the ambient air (Direct Air Capture), where it’s 0.04% can earn up to $180 per MT.

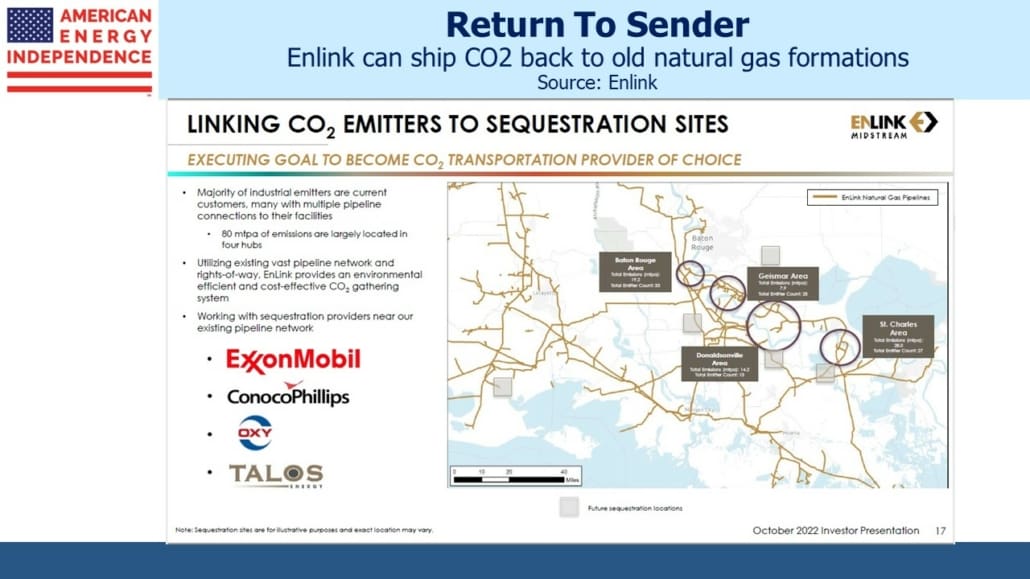

Under its new CEO Enlink is positioning itself as a key player in carbon capture. Their 4,000 mile natural gas pipeline network in southern Louisiana supplies the majority of industrial emitters in the region. In October they announced an emissions reduction agreement with CF Industries (CF) and Exxon Mobil (XOM) to capture 2 million MTs pa of CO2. CF Industries is a major producer of ammonia, the key input for which is natural gas. CO2 is a byproduct of this process. Enlink estimates the potential could be as much as 80 million MTs pa, over 1% of total US greenhouse gas emissions. CEO Arenivas said Enlink is aiming to be, “…the transporter of choice for carbon in Louisiana.”

Commodities typically flow from upstream companies (such as Exxon Mobil) via midstream (ie Enlink) to downstream customers like CF Industries. There’s an interesting symmetry in the agreement in that CF Industries will send the CO2 it generates through Enlink’s pipeline network back to the upstream companies who are best placed to understand which geological formations are suited for storage. The carbon is being returned to its point of origin. It left as CH4 (methane, or natural gas) and is returning as CO2.

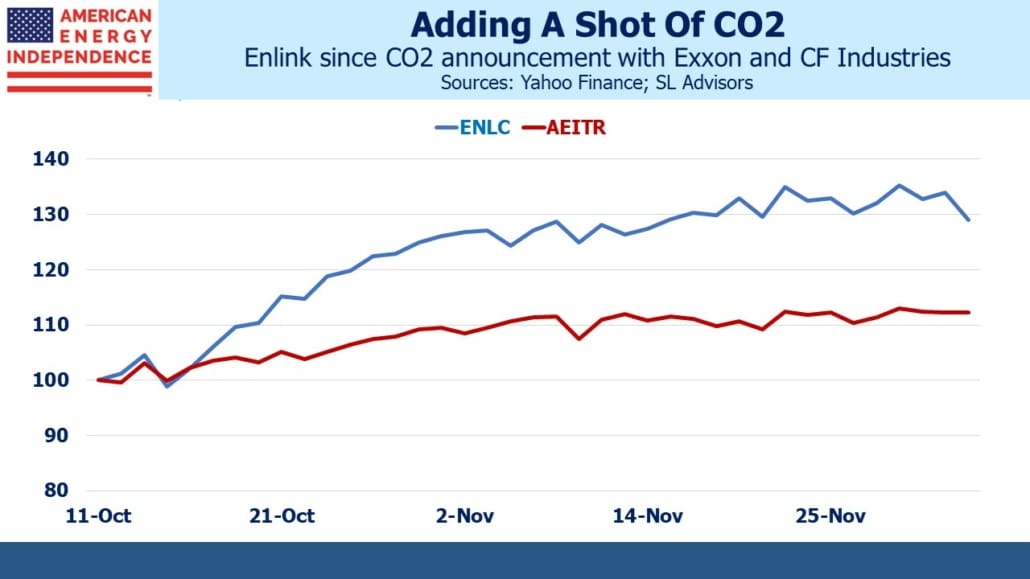

Since the agreement was announced on October 12th, Enlink has outperformed the American Energy Independence Index (AEITR) where it was a 2.37% weight at the last rebalancing on September 30. Midstream energy infrastructure companies are developing an important role in reducing CO2 emissions. For years climate extremists have opposed new pipeline construction thereby driving up free cash flow. Remember to hug a climate protester and offer them a ride. They’re vital to putting the CO2 underground.

Last week Enbridge and Occidental announced plans to develop a CO2 pipeline and sequestration hub near Corpus Christi in Texas. Occidental will handle the CO2 storage and Enbridge the transportation, in another example of reversing the traditional direction in which the commodity flows. When it comes to carbon capture, upstream is the new downstream.

Carbon capture is a twofold benefit for pipeline companies. Reducing the CO2 released into the air by petrochemical facilities demonstrates that natural gas consumption is not living on borrowed time, and the subsequent carbon capture offers a new revenue source.

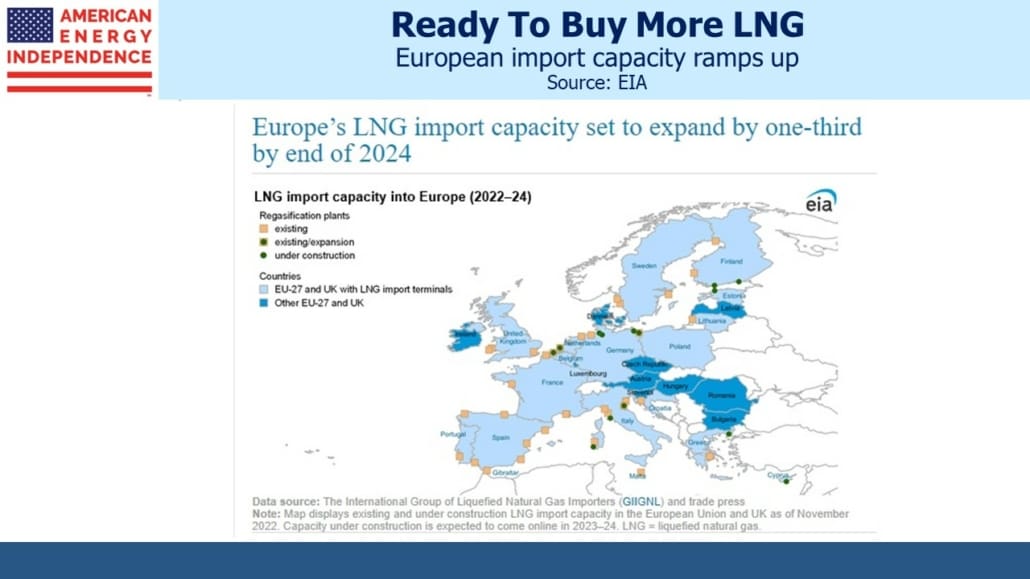

Meanwhile Europe is ramping up its capacity to import LNG. By 2024 they should be able to regassify 6.8 Billion Cubic Feet per Day, up by a third since 2021. Most of this additional capacity relies on floating storage and regassification units which can be operational more quickly than permanent, land-based facilities although they’re typically smaller as well. Poland is expanding capacity at an existing import terminal in the northwest. Within a couple of years there will be substantially more LNG tanker traffic through the North Sea and into the Baltic.

Until now Germany has never imported LNG, relying instead on natural gas from Russia via pipeline. Their energy policy is confused – long term goals to substantially reduce fossil fuel consumption remain in place, although they did recently sign a 15 year LNG deal with Qatar. They’re also contracting with trading house Trafigura to supply gas.

Enlink’s role in carbon capture is likely to be copied by other pipeline companies with similar infrastructure. This time we have no dinner plans with the management team.

More By This Author:

AMLP Trips Up On Tax ComplexitySome Energy Forecasts Are Aspirational

Why Aren’t Renewables Stocks Soaring?

Disclosure: We are invested in all the components of the American Energy Independence Index via the ETF that ...

more