Since The Gold Rally Has Stopped, Can A Reversal Be Expected?

Gold’s rally was just stopped by the resistance provided by its previous high and its 60-week moving average. Will gold now reverse?

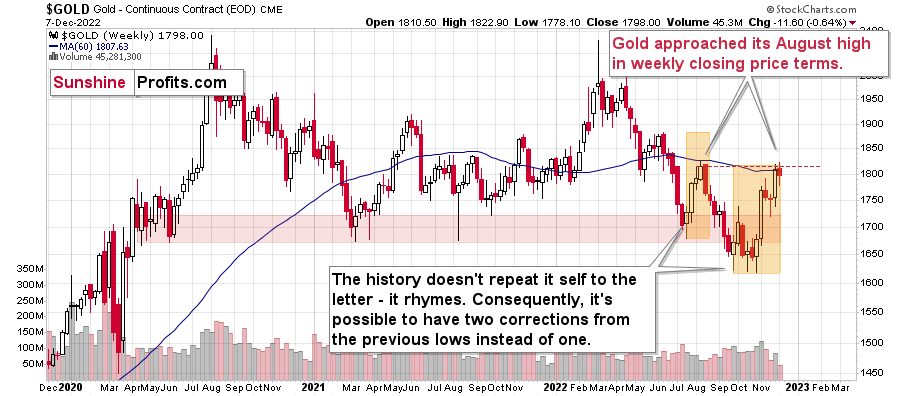

The above chart features gold price in terms of weekly candlesticks. As you can see, it just approached its August high.

And gold failed to move above it.

Last week, I wrote:

The resistance is provided by the weekly closing prices, and since the current week ends today (Dec. 2), it’s likely that gold’s rally was just stopped or that it will be stopped today.

The resistance held.

This week is not yet over, so don’t let the small size of this week’s volume fool you – it’s most likely not the case that gold is simply taking a breather. Zooming in provides extra details.

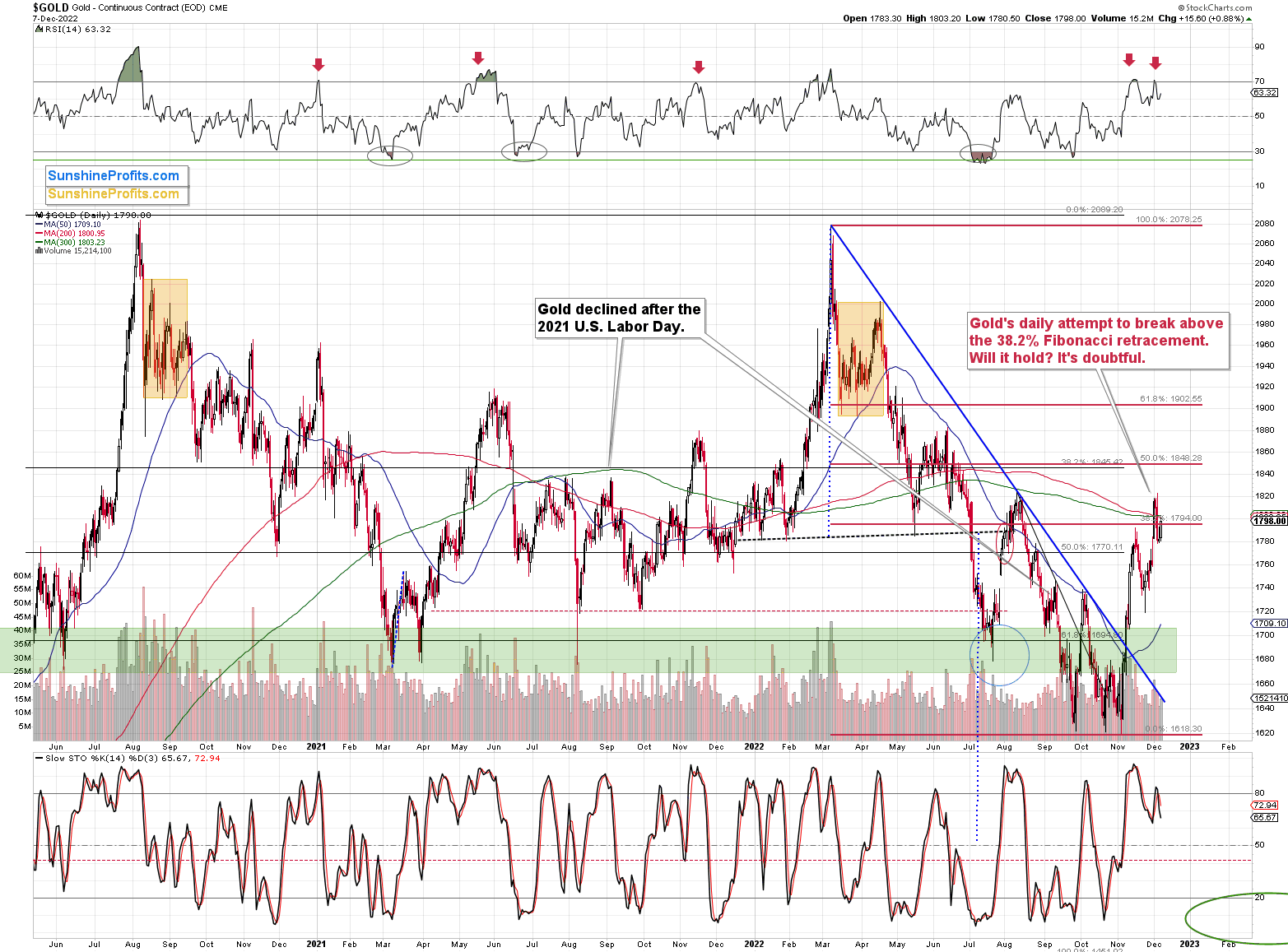

Gold, just like many other markets (i.a. stock prices), recently corrected slightly more than 38.2% of its previous move. And then it invalidated this small breakout.

During yesterday’s session, gold moved above this level once again, but only insignificantly so, and given the recent invalidation it’s unlikely that gold would be able to rally further.

If you click on the above chart and zoom it, you’ll see that right after the August top formed, gold also made a low-volume attempt to move higher. That was right before the start of the near $200 downswing.

The above happened even without the prior sell signal from the RSI indicator, and since we just saw the latter, a bearish outcome is even more likely.

Not to mention another signal from the silver-to-gold link (chart courtesy of https://goldpriceforecast.com/).

Silver moved to its yesterday’s intraday high, while gold didn’t.

Silver once again moved higher to a much bigger extent than gold did in today’s pre-market trading, and while the size of both moves is not huge, it’s something that confirmed the previous indications, and it’s a bearish sign.

Why would silver’s outperformance be a bearish sign?

First of all, because the history shows that it worked numerous times.

Second, the silver market is much smaller, and it’s much popular with individual investors / investment public. The institutions simply can’t buy a lot of silver without moving the market, so they are not that interested in it – besides, it hasn’t performed well in the past decade. Individual investors, however, can usually freely enter the silver market, and due to multiple reasons, they often do.

The thing is that the investment public is often the last to the party – individual investors often buy close to tops, and they sell close to bottoms.

And you can see this in the price movement – silver soars relative to gold close to tops in their prices.

Since we just saw it in today’s pre-market trading, it serves as a bearish confirmation.

More By This Author:

Invalidations Across The Market Have Major Implications For GoldThe Gold Market: The Name Of The Game Is Invalidations

How The USDX Helps Understand Gold Price Movements

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

Looks to me the gold rally just started a month ago 🤑🤑