Should Investors Buy Dollar Tree Or Walmart For 2023?

With inflation and the Fed’s tightening cycle still very much the main factors affecting the economy going into the new year investors may want to buy stocks that can benefit from this market environment.

Slower consumer spending could continue in 2023 with shoppers looking to save. Let’s dive into Dollar Tree (DLTR) and Walmart (WMT) stock as we round out the year and see if their low-cost offerings can capitalize on this scenario going into 2023.

Recent Performance

Dollar Tree stock was virtually flat this year vs. Walmart’s -2% drop in 2022. While this is not an overwhelmingly strong performance both stocks have been defensive at times and outperformed the broader market with the S&P 500 down -20% this year. Over the last two years, DLTR is up +31% to impressively outperform WMT and the benchmark.

(Click on image to enlarge)

Image Source: Zacks Investment Research

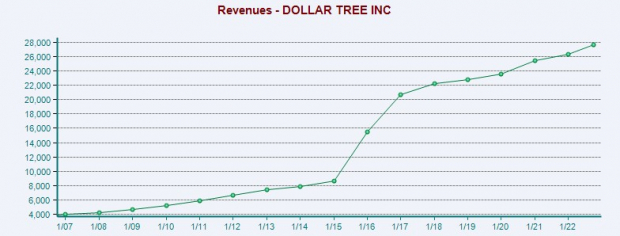

Dollar Tree’s low-price offerings for consumer merchandise at $1.25 per item have been ideal for many consumers to escape higher inflation. Dollar Tree stores raised their price offerings from $1.00 per item to improve margin and combat rising operating costs amid higher inflation. The company’s Family Dollar segment is also a viable option for savings and features a broader range of competitively priced merchandise which usually doesn’t exceed the $10 range.

(Click on image to enlarge)

Image Source: Zacks Investment Research

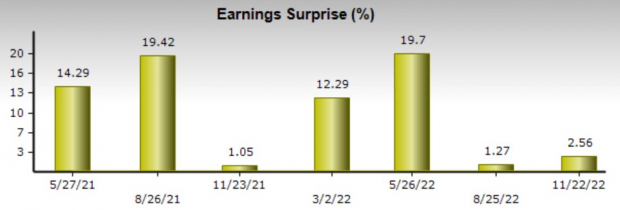

Dollar Tree has taken advantage of the current market environment beating earnings estimates for all three of its current fiscal year quarterly reports. In fact, DLTR’s earnings have beaten the Zacks consensus for 12 consecutive quarters dating back to March 2020.

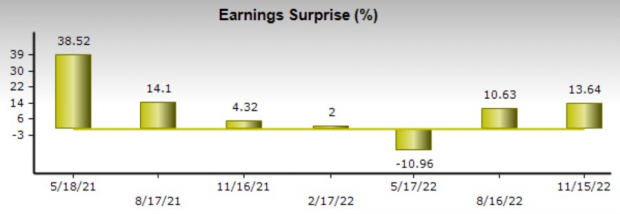

Walmart is a well-known option for consumer saving as well, famous for its rollback prices and price match guarantees that cross from basic consumer merchandise and household products to electronics, groceries, and home furnishing.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Unlike Dollar Tree, Walmart hasn’t shown quite the same consistency in its bottom line. Walmart has beat earnings expectations in its last two quarters but missed its fiscal first-quarter expectations earlier in the year after facing excess inventory challenges.

Growth & Outlook

Despite an impressive string of earnings beats even Dollar Tree stock has hit some rough patches throughout the year after lowering its full-year earnings outlook in August.

Still, Dollar Tree earnings are expected to climb 24% in its current fiscal 2023 and jump another 9% in FY24 to $7.85 per share. Earnings estimates have trended down over the last 60 days. Sales are projected to be up 7% in FY23 and rise another 6% in FY24 to $29.85 billion.

(Click on image to enlarge)

Image Source: Zacks Investment Research

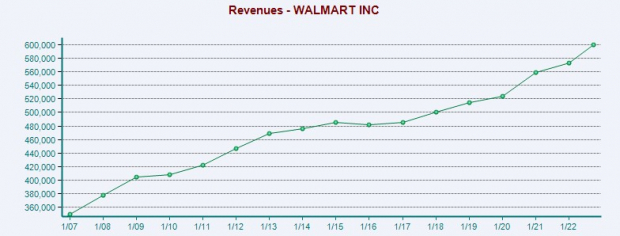

Pivoting to Walmart, earnings are forecasted to decline -6% in FY23 but rise 8% in FY24 at $6.55 per share. Even better, earnings estimates have gone up for both FY23 and FY24 over the last 60 days. On the top line, sales are projected to be up 6% in FY23 and rise another 3% in FY24 to $623.76 billion.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Valuation

With Dollar Tree and Walmart stocks looking like viable investment options in 2023 based on their growth, monitoring their valuation will be important. On that note, both Dollar Tree and Walmart stock trade around $140 per share at the moment with DLTR trading at 19.9X forward earnings and WMT at a 23.3X forward earnings multiple.

Image Source: Zacks Investment Research

Dollar Tree appears to have a slight edge in valuation as it trades 38% below its decade high of 32.5X and near the median of 19.1X. Walmart on the other hand trades 17% beneath its decade-long high of 28.1X but 30% above the median of 18.1X.

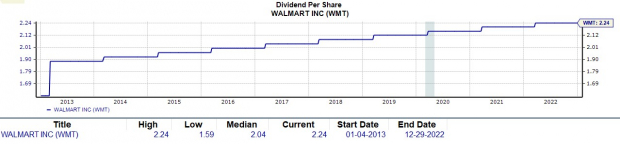

Dividends

In the current market environment, dividends also come in handy and Walmart evens the playing field in this regard. Dollar Tree doensn't offer a dividend to shareholders at the moment as the company continues to focus on growth and expansion of its store fronts. WMT pays a respectable 1.58% annual dividend yield at $2.24 per share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Both Dollar Tree and Walmart stock land a Zacks Rank #3 (Hold) at the moment. Both stocks look like solid investments going into 2023 and may continue to outperform the broader market. More upside in DLTR and WMT stock may largely depend upon their fourth-quarter earnings reports, but holding these equities could prove beneficial for investors as consumers look to save.

More By This Author:

3 Small-Cap Blend Mutual Funds For Fantastic Returns

Buy These 3 Mid-Cap Blend Mutual Funds For Solid Returns

Bear Of The Day: CarMax - Thursday, Dec. 29

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more